June 15, 2023

JAKARTA – Indonesia was the biggest online spender in South-east Asia in 2022, with a new study finding that the archipelago accounted for more than half of the purchases on digital platforms in the region.

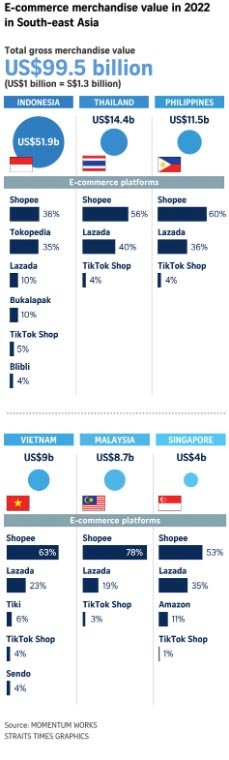

A report released on Thursday by Singapore-based venture firm Momentum Works found that Indonesia contributed 52 per cent of the region’s total gross merchandise value (GMV), which refers to the value of goods sold via e-commerce platforms.

The amount was calculated based on the spendings of six South-east Asian countries that also included Malaysia, the Philippines, Singapore, Thailand and Vietnam. The total GMV in 2022 was reported to be US$99.5 billion (S$133.4 billion).

Indonesia’s figure was US$51.9 billion, almost 13 times that of Singapore’s US$4 billion.

Momentum Works conducted its research using a variety of methods, including the analysis of publicly available data and gathering information from contacts in the e-commerce industry.

The firm found that in Indonesia, the most commonly used platforms were e-commerce app Shopee and online marketplace Tokopedia, which accounted for 36 per cent and 35 per cent of the country’s GMV respectively.

Trailing behind were Lazada and Bukalapak both at 10 per cent, TikTok Shop – the e-commerce affiliate of the video-sharing app – at 5 per cent, and Blibli at 4 per cent.

The report is the first instalment of Momentum Works’ E-commerce in South-east Asia series. The GMV in the region totalled US$99.5 billion in 2022, up from US$87.1 billion in 2021 and US$54.8 billion in 2020, according to the report.

This means that the rise in online spending from 2021 to 2022 was less than that from 2020 to 2021, with the growth falling from 58.9 per cent to 14.2 per cent.

In the report, the firm said that as the world reopened after the Covid-19 pandemic, the resumption of retail shopping across the region meant that the frequency of online purchases would be impacted.

“In addition, inflation and rising interest rates as well as the hikes in commodity prices not only impact consumer spending power, but also force many platforms in the region to cut marketing and operational investments,” it said.

Still, e-commerce will continue to grow, added the report, citing how some firms in the industry like TikTok have been making gains in GMV growth, and how others like Lazada have sought to put their growth on the top of their agenda.

“E-commerce overall will continue to grow, at a probably healthier pace, commensurate with the region’s pace of (consumer) income growth, infrastructure development, and progress of fulfilment capacity/capabilities,” the report said.

Looking at specific companies, the report found that Shopee was the largest e-commerce player in South-east Asia, clocking close to half of the total GMV in 2022 at US$47.9 billion.

This was followed by Lazada at US$20.1 billion, Tokopedia at US$18.4 billion and TikTok Shop at US$4.4 billion.

The report made a special mention of TikTok Shop, noting how the app and its parent company ByteDance have been putting in efforts to expand into the region.

Momentum Works said that the app is reportedly targeting to more than triple its regional GMV, but whether it can actually achieve that is uncertain.

In 2021, TikTok’s GMV in South-east Asia was US$600 million. This grew by US$3.8 billion to US$4.4 billion in 2022.

In contrast, Tokopedia’s GMV went up by only US$2.9 billion in the same timeframe, while Lazada’s numbers fell by US$900 million, said the report.

“While TikTok offers users a differentiated experience as compared to traditional e-commerce platforms in the region, whether the platform can build such an experience into a mainstay of e-commerce in South-east Asia, with a mature e-commerce content ecosystem, remains to be seen,” said the report.