July 8, 2019

India set to retain title of fastest growing economy.

When India’s Finance Minister Nirmala Sitharaman presented the Union Budget to Parliament on 5 July, it underlined the effort by New Delhi to headline the fact that it is still the fastest growing major economy in the world.

India, now the globe’s sixth largest economy, was projected to become a $3 trillion economy in the current fiscal year(2019-20) up from $2.7 trillion as of today and on its way to becoming a $5 trillion economy by 2024.

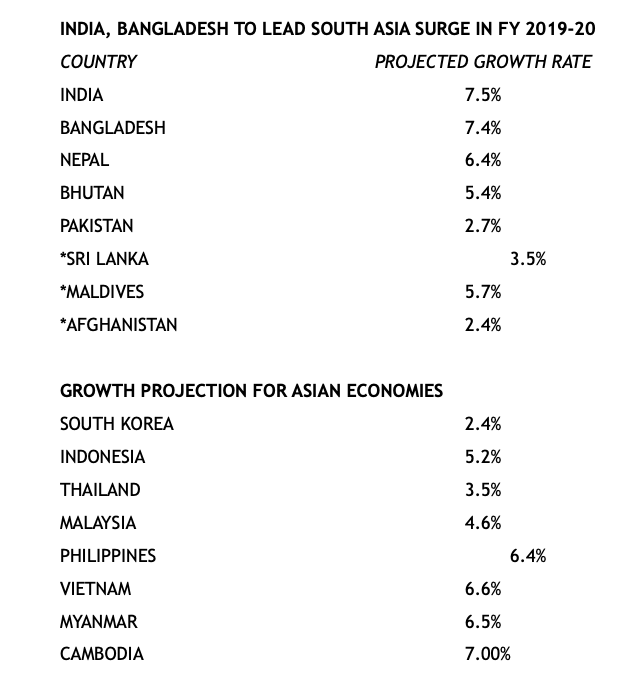

Crucially, GDP growth has been pegged at 7.5% for India by the World Bank in its latest report buttressing the government’s claim.

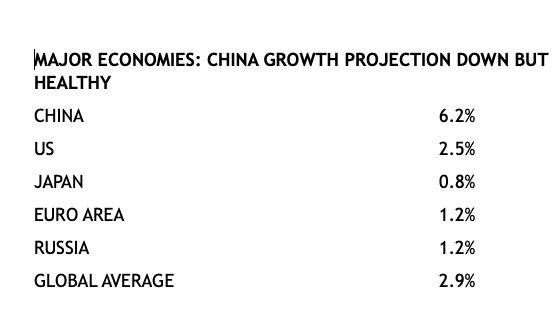

India’s growth projection is well ahead of the other major Asian economy of comparable size, China. The ongoing trade war and structural issues have resulted in the World Bank moderating China’s expected growth rate to 6.2%.

Of the other economies in Asia, Japan is projected to grow at 0.8%, South Korea at 2.4%, Indonesia at 5.2% and Malaysia at 4.6%. Bangladesh is expected to post a robust growth figure of 7.4%. (See Table 1 below.)

Breaking down the growth

Infrastructure is the major sector which is expected to drive growth in India and the Budget spelt out the priority given to connectivity via all forms of transportation.

The Prime Minister’s Village Roads Scheme, Industrial Corridors, Dedicated Freight Corridors, Inland and Coastal Waterways Projects, Greenfield Airports, Railways Upgradation and Freight/Container multi-modal terminals at all major transport hubs are all part of the infrastructure push.

An estimated 1,25,000 km of roads will be upgraded over the next five years.

An expert committee is to be established to recommend the structure and required flow of funds through development finance institutions.

A key aspect of the Modi Administration’s Budget is on Foreign Direct Investment (FDI).

Sectors including aviation, media (animation, AVGC) and insurance are proposed to be opened up further after a multi-stakeholder examination, while insurance intermediaries will get 100% FDI, Sitharaman announced.

Local sourcing norms will be eased for FDI in the Single Brand Retail sector.

The government will organize an annual Global Investors Meet in India using the National Infrastructure Investment Fund (NIIF) as an anchor to get all three sets of global players (pension, insurance and sovereign wealth funds) under one roof.

The statutory limit for FPI investment in a company is proposed to be increased from a blanket 24% to the specific sectoral foreign investment limit.

Boosting domestic corporate growth in the medium enterprises sector, a key to creating more well-paying jobs, is a key objective for India to which end Sitharaman announced a tax rate reduction to 25% for companies with an annual turnover up to Rs 4000 million rupees.

The government is also pushing the clean energy sector which is sought to be developed by offering upfront incentives on the purchase of electric vehicles (EVs) and development of charging infrastructure.

An additional income-tax deduction of Rupee 150,000 on interest paid on EV loans was announced in the Budget. Customs duties will be exempted on electric vehicles parts and the GST rate on EVs has been slashed from 12% to 5%.

Unlocking the value of real estate is also expected to provide a significant boost to growth with the Budget proposing a Model Tenancy Law to replace current rental laws which are archaic and unrealistic in dealing with the lessor-lessee relationship.

On the banking and finance side, raising the threshold for minimum public shareholding in listed companies from 25% to 35% is aimed at kickstarting investment and expansion.

Transfer/sale of investments by FIIs/FPIs in debt securities to any domestic investor within the specified lock-in period is also on the anvil.

The government’s disinvestment target from state-owned entities for the FY 2019-20 has also been increased and the present policy of retaining 51% government stake in these entities is proposed to be watered down.

To encourage entrepreneurship, the government has announced that funds raised by start-ups will not require scrutiny from the Income Tax Department.

The Indian economy has largely managed to avoid any major negative impact of the China-US trade war but it does have its own tariff tiff ongoing with Washington which is a cause of worry for the government.

American geopolitics and strategic concerns, however, especially in relation to China’s growing heft to which many in the US establishment see India as a counterweight, have ensured the disagreements – despite a periodic raising of tariffs by each side on some products from mangoes to Harley Davidson motorcycles – have not become a full-scale trade war.

Thus far, New Delhi has more or less successfully negotiated bilateral deals with Washington for exemptions/waivers on key issues including Iranian oil imports and the purchase of Russian S-400 missile defence systems.

But going ahead, a key area of disagreement is developing in the technology sector, one of the most robust in US-India economic relations.

India wants all data to be stored by multinational technological companies within its geographical boundaries, something the tech giants have successfully lobbied the Donald Trump Administration to oppose vociferously.

The Budget’s indirect tax proposals are focussed on using the funds generated to meet the target of providing electricity and clean cooking facilities to all rural families by 2022, fulfilling the aims of the Prime Minister’s Rural Housing Scheme – ‘Housing for All – by the same year and encouraging upgradation/regeneration of traditional industries.

Other welfare schemes for both the urban and rural poor will also be funded by the revenue that accrues.

To prepare India’s young population for overseas jobs, Sitharaman announced the setting up of a Higher Education Commission of India which would focus on imparting globally valued skill-sets including language training, AI, IoT, Big Data, 3D Printing, Virtual Reality and Robotics.

A set of four labour codes has also been proposed in the Budget to streamline multiple labour laws in India but the devil is likely to be in the implementation as trade unions will oppose any changes.

As a step to formalise the economy, a 2% will be imposed at source on cash withdrawals exceeding Rs 10 million a year from a bank account.

Digitising the economy has also been pushed with business establishments with an annual turnover of more than Rs 500 million now obliged to offer low cost digital modes of payment to customers. No charges will be imposed on either the merchant or the customer for such transactions.

The Finance Minister said the fiscal deficit this year was 3.3 per cent, brought down from 3.4 per cent. The revised fiscal glide path envisages achieving a fiscal deficit of 3 per cent of GDP by FY 2020-21.

This was the first full Union Budget of the Prime Minister Narendra Modi-led National Democratic Alliance (NDA) government after being re-elected.

VIEW FROM THE GALLERY

- In a departure from British-era colonial practice, Sitharaman carried the Budget speech and papers in a traditional Hindu red-cloth folder bound by a string and emblazoned with the national emblem.

- India’s super-rich would have to now pay higher taxes as the surcharge has been raised – the effective tax rate for people earning from Rs 20 million to Rs 50 million per year would be 39 per cent, up from 35.8 per cent. For those with more than Rs 50 million taxable income per annum, the new tax rate would be a whopping 42.74 per cent.

- A new series of coins of Re 1, Rs 2, Rs 5, Rs 10, Rs 20 denomination which are braille-friendly and easily identifiable by the visually impaired, will be made available for public use shortly.

- An online portal christened ‘Gandhipedia’ is being developed on the lines of Wikipedia by the National Council for Science Museums to sensitize the youth to Gandhian values.

- Sitharaman, India’s first woman finance minister to present the full Union Budget, also drew attention to the need to empower women, announcing budgetary support for female-led entrepreneurship by expanding the Women Self Help Group (SHG) Interest Subvention Programme to all 724 districts in India.

- To popularise sports at all levels, budgetary allocation for a National Sports Education Board is to be established to promote the ‘Khelo India’ i.e. Play India programme.

- India’s influence and leadership in the international community to be aided by opening Indian embassies in four (mainly African) countries this year where India does not have a resident diplomatic mission as yet.