July 13, 2022

SINGAPORE – Singapore replaced China as the top investment destination for Temasek in its last financial year, when the value of its net portfolio rose above $400 billion for the first time despite volatile market conditions.

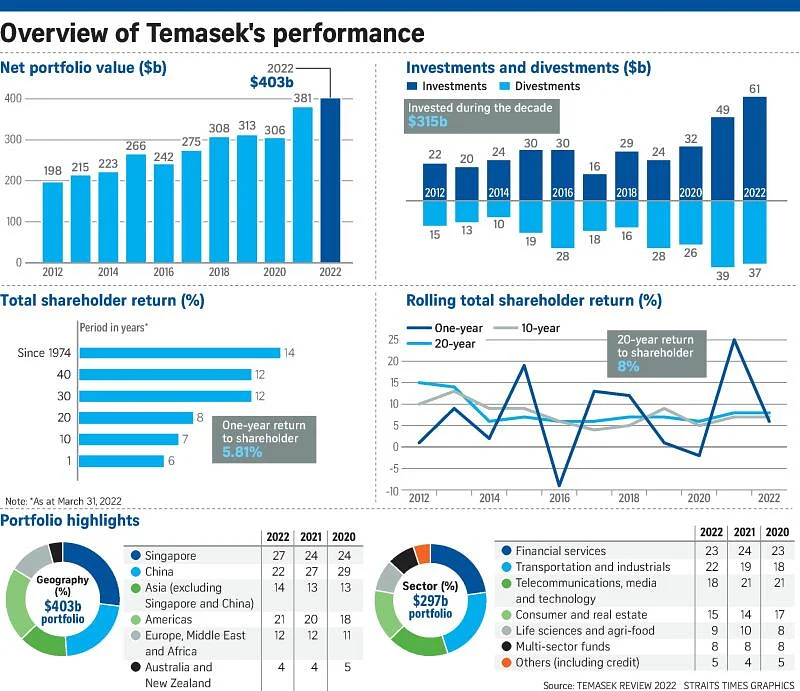

Counted as one of the world’s top investors, Temasek said in its annual review on Tuesday (July 12) that it had invested $61 billion and divested $37 billion in the year ended March 31, 2022. That boosted its net portfolio to a record $403 billion for the period.

The portfolio was valued at $381 billion as at end-March last year.

The state investor achieved a dividend income of $9 billion in 2021-2022, up from $8 billion in the previous financial year.

However, the one-year return for shareholders fell to 5.81 per cent amid global market volatility, with steep drops seen in technology stocks that have suffered bouts of sell-offs from China to the United States.

The one-year return is down from 24.53 per cent in the financial year ended March 31, 2021. The financial year 2021 returns were Temasek’s highest since 2010, when returns stood at 43 per cent.

Ten-year returns came at 7 per cent and 20-year returns at 8 per cent.

Mr Rohit Sipahimalani, Temasek’s chief investment officer, said short-term returns are volatile as they depend on the financial markets, whose performance may vary widely from one year to the next.

“For a long-term investor like Temasek, returns on the 10- to 20-year horizon are more representative of its performance,” he said.

Temasek’s total shareholder return stands at 14 per cent since its inception in 1974.

Temasek’s investments benefit Singaporeans through its Net Investment Return Contribution (NIRC) to the annual Budget.

Under the NIRC framework, the Government can spend up to half of the long-term expected investment returns generated by Temasek, sovereign wealth fund GIC and the Monetary Authority of Singapore – the three entities tasked to invest Singapore’s reserves.

Market volatility that lowered returns was more pronounced in China due to its Covid-19 lockdowns and a regulatory crackdown on the technology and property sectors.

Meanwhile, the Singapore market did well, backed by the phased relaxation of Covid-19 curbs that allowed companies to take advantage of pent-up demand.

Singapore assets now comprise 27 per cent of Temasek’s portfolio, up from 24 per cent a year earlier. Exposure to China dropped to 22 per cent from 27 per cent in the same period.

The last time Singapore holdings took the top ranking in its portfolio was in 2018, when they accounted for 27 per cent.

Ms Ming Pey Lim, managing director of the strategy office at Temasek, said investments in Singapore were driven mainly by the purchase of the second tranche of Singapore Airlines’ Mandatory Convertible Bonds and of rights share issue of Sembcorp Marine.

She stressed that Temasek’s investment view on China has not changed despite rising uncertainty over the country’s growth outlook.

The share of listed assets also fell victim to the global market downturn and inflated the value of unlisted assets to 52 per cent of its portfolio, up from 45 per cent in the past.

The company said that even otherwise returns on its portfolio of unlisted assets have exceeded those of listed assets over the past 20 years.

Given Temasek’s bottom-up investment approach, where it buys assets that are likely to give steady returns in the longer run, the value of unlisted assets in Temasek’s portfolio have risen by four times to $210 billion, from just $53 billion a decade ago.

Mr Sipahimalani said unlisted companies, for instance SP Group and PSA, have consistently supplied a steady stream of dividend income for Temasek.

However, he pointed out that Temasek does not target a certain share of listed or unlisted assets and has no geographical preferences either.

He said Temasek invests in assets that can deliver sustainable returns in the long term and are aligned to four structural trends – digitalisation, sustainable living, future of consumption and longer lifespans – that shape the company’s long-term portfolio construction.

The financial sector remained Temasek’s top exposure, at 23 per cent, but the transport and industrials sector replaced technology, media and telecoms (TMT) for the second place.

Eighteen per cent of its portfolio now comprises TMT assets, down from 21 per cent, while exposure to transport and industrials is up 22 per cent from 19 per cent.