February 16, 2022

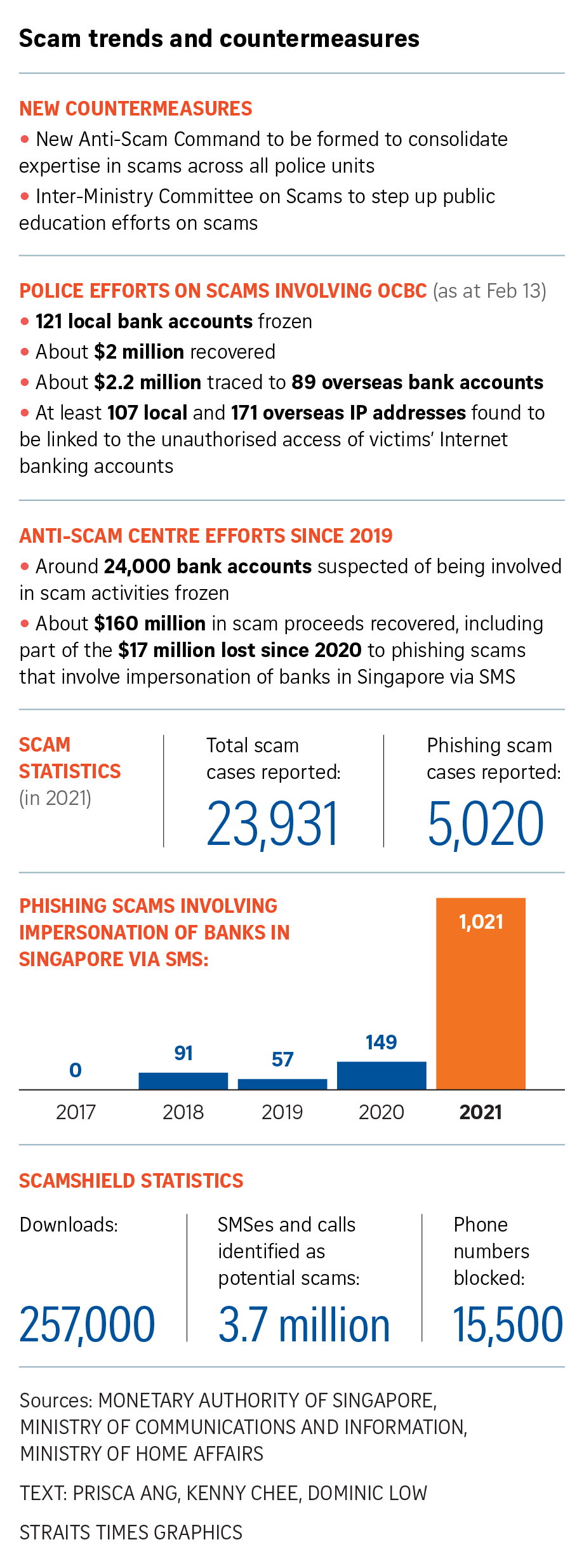

SINGAPORE – The police have frozen 121 local bank accounts and recovered about $2 million lost by victims in phishing scams targeting OCBC Bank customers as at Sunday (Feb 13), said Minister of State for Home Affairs Desmond Tan.

Providing an update on the ongoing investigations into the OCBC phishing scams which took place last December, Mr Tan also said that about $2.2 million of victims’ funds have been traced to 89 overseas bank accounts.

“Many of the scam websites used in the phishing scams were hosted by web hosting companies based overseas,” said Mr Tan, who chairs the Inter-Ministry Committee on Scams (IMCS) set up in April 2020.

Specifically, at least 107 local and 171 overseas Internet protocol (IP) addresses were linked to the unauthorised access of the victims’ internet banking accounts.

He was replying MPs Tan Wu Meng (Jurong GRC), Sitoh Yih Pin (Potong Pasir SMC) and Dennis Tan (Hougang SMC), who asked for an update in Parliament on the ongoing investigations into the OCBC phishing scams.

The police have commenced investigations into the local IP addresses linked to the scams and the owners of the local money mule accounts.

The police are also working with Interpol and foreign law enforcement agencies to investigate the beneficiaries of the funds transferred overseas and the hosts of the scam websites.

Mr Tan was not able to divulge more information as investigations were still ongoing.

But he noted that OCBC customers fell prey amid a sharp increase in the number of scams reported in Singapore.

Phishing scams involving SMSes that impersonated banks in Singapore have increased significantly, from 149 cases in 2020 to 1,021 last year. The OCBC scams were the largest case involving such fraudulent schemes.

Overall, there were 23,931 cases of scams reported last year, of which 5,020 were phishing scam cases.

MPs Ang Wei Neng (West Coast GRC) and Cheng Li Hui (Tampines GRC) asked for the number of similar scams reported over the past five years and if the police were well-resourced to tackle scam-related crime.

Mr Tan said: “The use of a combination of highly orchestrated tactics, involving spoofed SMSes appearing in the same thread as genuine messages from the bank and links directing victims to a scam website, as well as the large number of customers targeted in the OCBC scams, show that the threat is now significantly heightened.”

He also said that people aged between 20 and 39 formed the largest group of victims of phishing scams and those related to jobs, e-commerce, investments, loans, China official impersonation and fake gambling platforms.

The largest group of victims of social media impersonation scams and those involving Internet love and fake friend calls were those aged between 40 and 59.

Responding to a question by Associate Professor Jamus Lim (Sengkang GRC) about unauthorised transactions made on credit cards in the past year, Mr Tan said card fraud cases reported by major credit card issuers here to the Monetary Authority of Singapore made up less than 0.1 per cent of total credit card transactions.

Mr Tan noted that the police are extremely stretched, with officers trying to cope with increasing workload and expectations without a proportionate increase in manpower.

But the Anti-Scam Centre has frozen around 24,000 bank accounts suspected of being involved in scam activities and recovered about $160 million in scam proceeds since it was set up by the police in 2019.

The amount recovered included part of $17 million lost since 2020 to about 1,300 cases of phishing scams involving spoofed SMSes that impersonated banks here, added Mr Tan.

He emphasised that recovery of money lost to scams is difficult, adding that where such sums have been recovered by the police, it involved the help of financial institutions.

Mr Tan noted that the police will be forming an Anti-Scam Command this year to consolidate expertise in scams across all police units, thereby improving coordination of anti-scam enforcement and investigations.

The police uses technology to automate manual work processes in its fight against scams, including the generation of electronic production orders to banks for the freezing of bank accounts associated with scams.

“This allows police resources to focus on critical investigations and enforcement work,” Mr Tan said.

The police is also using other technology, such as the ScamShield app, to crowdsource information on scam calls and SMSes.

Mr Tan said ScamShield – developed by the National Crime Prevention Council in collaboration with Open Government Products, a division of the Government Technology Agency, and the police – has been downloaded about 257,000 times to date.

About 3.7 million SMSes and calls have been identified as potential scams by the in-app algorithm and by user reports through the app, while about 15,500 phone numbers have been blocked.

“ScamShield picked up and filtered about 2,000 scam messages used in the OCBC phishing scams,” said Mr Tan. “Unfortunately, a lot more scam messages managed to reach the SMS inboxes of ScamShield users, mainly because they appeared in the same thread as legitimate messages.”

He said this gap will be plugged to counter spoofed SMSes.

While ScamShield is currently only available for iOS devices, Mr Tan said an Android version is planned to be released in the next few months.

The IMCS will step up public education efforts on scams. For example, it has started working with the Agency for Integrated Care, the Ministry of Education, the Ministry of Manpower and MoneySense to educate seniors, students, migrant workers and professionals on scams.