June 14, 2023

SEOUL – Pawn shops have been seen as relics of the past, from a time when instant cash loans were not so readily available with just a few clicks.

But though many perished, a new breed of shops has emerged, catering to clients who possess expensive gadgets or luxury goods but are temporarily cash-strapped.

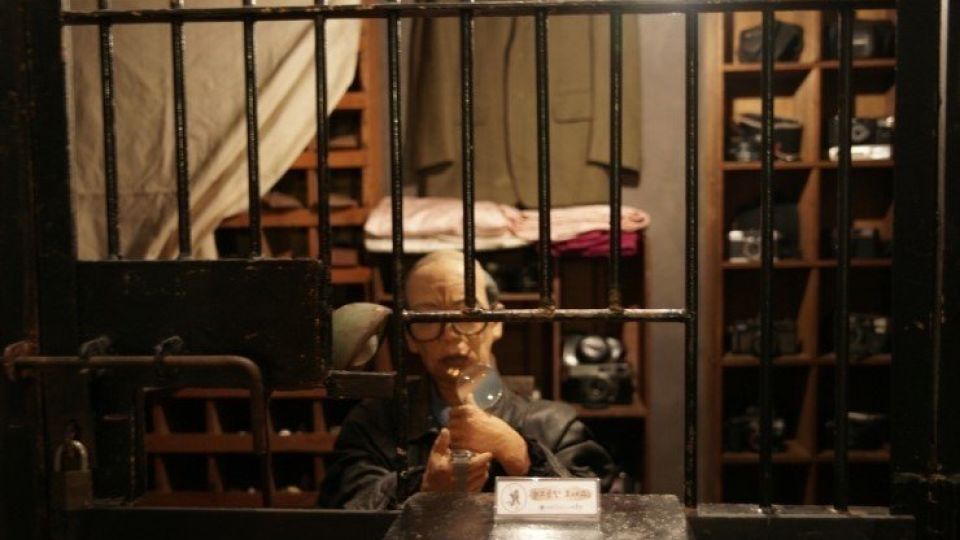

Lee Yong-seok’s shop in Seoul’s bustling Hongdae specializes in loans secured against tech gadgets. In contrast to the traditional image of pawn shops with iron bars and stringent security measures, his shop resembles an ordinary store, featuring boutique-style showroom cases displaying luxury wallets, smartphones and tablet PCs.

Clients are mostly in their 20s and 30s, according to Lee.

“They usually borrow a small amount of money, between 200,000-300,000 won ($160-$240), leaving behind their laptops or digital cameras as collateral. More university students or job seekers in their 20s have visited in recent years,” he said.

A pawn shop in Hongdae that specializes in tech devices (Lee Yong-seok)

Han Jung-woo, a 35-year-old who runs a small online marketing business in Seoul, recently took out a loan of 2 million won from a local pawn shop based on computer monitors and laptops as collateral.

“Clients don’t pay upfront after signing a contract, which creates a cash crunch,” he said, adding that the loans are to cover employee costs.

For photographers or video producers, a visit to a pawn shop can be a way to unlock their investment in equipment – high-function cameras and other filming equipment that cost millions of won – to ride out a temporary cash shortage.

Cho, a 31-year-old photographer who opened a small photo studio in Seongsu-dong, eastern Seoul, said, “I received small loans at several pawn shops by offering some old cameras to cope with additional expenses needed to operate the shop.”

As of last year, there are approximately 1,150 pawn shops operating nationwide, and around 200 of them are known to accept electronic devices from borrowers, according to the Korean Consumer Loan Finance Association.

A pawn shop in Seoul’s Gangnam resembles a boutique shop. (Cashroad Seoul)

The balance of outstanding collateral loans at 8,775 lending institutions nationwide, including pawn shops, surged 12.3 percent on-year to 8.54 trillion won in 2022 from 7.61 trillion won in 2021, government data showed.

‘Bring ID and valuables’

Pawn shops serve as a last resort for underserved and marginalized financial consumers who are unable to access credit from first- or second-tier lending institutions, particularly due to poor credit records. This includes foreigners who have just settled down in Korea and have yet to establish a favorable credit rating.

Pawn shops do not check a client’s credit score, they only check the client’s ID and the authenticity and market value of the item being offered as collateral or to be pawned.

Foreigners who present their passports or foreign residence cards can receive small loans secured on their collateral, according to Hongdae shop owner Lee.

A fast-track lending process that leaves no trace on one’s credit history is another plus.

But beware, as pawn shop loans could carry substantially higher interest rates above the legal cap of 20 percent a year.

Some pawn shops were found to charge around 3 percent interest per month, or 36 percent per annum.

It is significantly higher than the average interest rate of 5.23-5.78 percent per annum charged by the top five lenders here — KB Kookmin, Shinhan, Woori, Hana and NongHyup — in April, according to data from the Korea Federation of Banks.

Pawn shops enjoying a boom is a worrying sign of a deteriorating economic conditions or the growth of credit-poor consumers, experts say.

Kang Kyung-hoon, a professor of business administration at Dongguk University, said, “The so-called ‘pawn shop’ finance usually thrives in a poor economy where there is not sufficient financial support from first-tier and secondary lenders. Its prevalence is not an ideal situation as it signifies the limited role of institutional finance.”