November 28, 2024

BANGKOK – Over the past decade, Thailand has been a primary destination for Japanese investment. Japan’s net foreign direct investment (FDI) in Thailand accounts for 22% of its total investment in Southeast Asia (second only to Singapore) and over 36% of Thailand’s total foreign investment.

Japan began investing in Thailand in the 1960s, becoming one of the first foreign countries to establish a presence in Southeast Asia. At the time, Thailand attracted Japanese investment due to its high economic growth rate (averaging 5% annually), low labour costs, robust infrastructure, and political stability.

However, rising geopolitical tensions, particularly the intensifying trade conflict between the US and China, have significantly impacted global trade and investment. Since Donald Trump’s first term as US president, trade between the US and China has declined from 16% of total US trade in 2016 to just 11% in 2023.

Foreign businesses in China have sought to mitigate risks by diversifying investments to other countries, a strategy widely known as “China Plus One”. Japan has also relocated investments out of China as part of this approach.

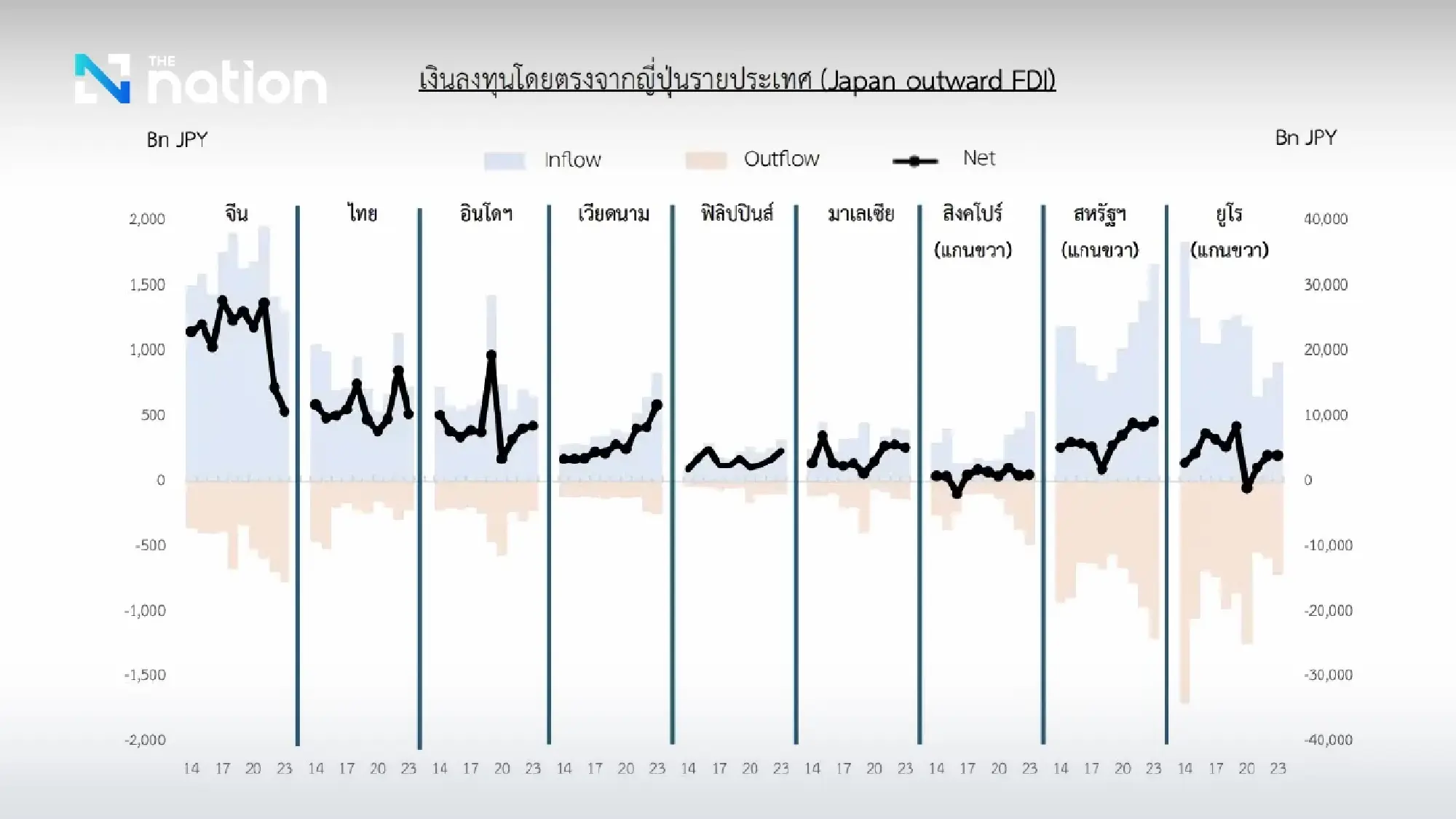

Comparing Japanese investments during 2014–2020 and 2021–2023, Japan’s net investment in China decreased by ¥0.3 trillion (-39%). In contrast, Japanese investments in Southeast Asia rose by ¥1.1 trillion (+33%), driven by the region’s proximity to China and its well-established supply chains.

CHART: THE NATION

However, Thailand is no longer the top destination for new Japanese investments in Southeast Asia. From 2021 to 2023, Vietnam overtook Thailand as the second-largest recipient of Japanese investments in the region after Singapore. Vietnam’s net investments from Japan surged by ¥260 billion (+54%), primarily in AI and semiconductor industries, which are considered megatrends.

Meanwhile, Thailand’s net investments increased by only ¥80 billion (+13%), causing its ranking to drop to third in the region for Japanese investment.

According to the latest 2023 survey by the Japan Bank for International Cooperation (JBIC), Japanese investors view Vietnam as having the most positive outlook for business opportunities over the next three years compared to other Southeast Asian countries.

Vietnam’s rising appeal over Thailand as an investment destination stems from several factors:

Robust economic growth: Vietnam’s economy is expanding at an annual rate of 5-6%, driven by consumption, investment, and exports.

Growing workforce: Vietnam boasts a labour force of over 56 million people, with an average population age of 34.1 years, representing both a productive workforce and a growing domestic market.

Competitive labour costs: Vietnam’s minimum wage equates to about 8,800 baht per month, coupled with moderate English proficiency and high PISA scores (ranked 34th globally) in science, mathematics, and reading among its youth.

In contrast, Thailand is gradually losing its competitive edge in attracting foreign investment, particularly from Japan – its largest investor – due to several challenges:

Higher wages: Thailand’s labour costs are higher than those of other countries in the region.

Ageing population: The shift towards an ageing society is reducing the country’s labour supply.

Mismatch in workforce skills: The skills of Thai workers often do not align with industry needs, limiting Thailand’s ability to compete based on low labour costs as it did in the past.

To regain its position and attract foreign investment, particularly in emerging industries, Thailand must prioritise improving workforce skills and increasing the number of highly skilled workers. Key recommendations include:

Upskilling the workforce: Equip workers with skills for high-value, technology-driven industries through government-private sector collaboration, focusing on education and training aligned with market demands.

Attracting skilled foreign workers: Allow skilled foreign professionals to fill gaps in emerging industries while enabling knowledge transfer to local workers. This could involve relaxing restrictions, such as permitting licensing exams in non-Thai languages and increasing the proportion of foreign employees allowed in companies.

Although Thailand remains a significant manufacturing base due to its strong existing supply chains, the decline in foreign investment highlights global shifts and future challenges for the country. Without adaptation, Thailand risks being left behind in a changing world.

Swift reforms and a focus on attracting future industries through human capital investment will be essential for Thailand’s long-term economic stability and sustainability.

Metha Yuwannasiri, Bank of Thailand

This article reflects the author’s personal views and may not align with the opinions of their affiliated organisation.