July 27, 2022

DHAKA – Until recently, load-shedding was something that people in Bangladesh had forgotten – at least in Dhaka. Why, then, are we facing the present power crisis, and why should it hit us so hard? Simply put, we ignored the issue of fuel supply for the power plants. There are grid-connected power plants with more than 22,000MW generation capacity, but our consistent electricity production is less than 17,000MW even from our oil-fired power plants, because we haven’t planned for sufficient gas supply.

Power is measured with megawatt (MW), but electricity is measured with megawatt-hour (MWh). We have had growth in power, but not in electricity generation. To generate electricity, one needs fuel – and we have failed in planning for fuel supply for our power plants. If said fuel is imported, supply disruption must be integrated into that planning.

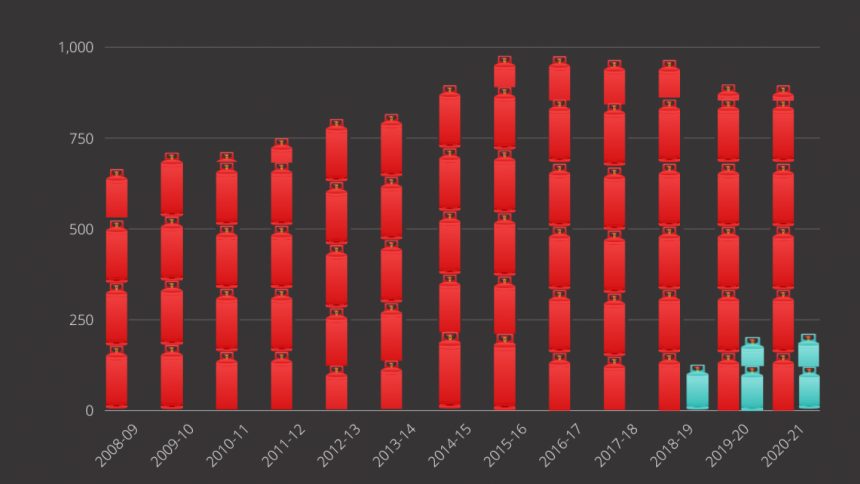

The figure below shows the production of natural gas and the import of LNG in Bangladesh since 2008-09. As we can see, gas production peaked in 2015-16, and then started to decline. LNG import started in 2018-19, and has been increasing every year. The need to manage the declining gas production and increasing LNG import is of utmost importance. We are now alert to the dangerous situation that started developing at least five years back. Our daily production is 2,300 mmcf, and in the best possible scenario, on an average, we can import, gasify and supply 1,000 mmcf of regasified LNG daily. That makes a total of 3,300 mmcf of gas per day, but our daily demand is more than 3,800 mmcf; some believe it is more than 4,500 mmcf per day if unsatisfied and suppressed demands are fully met.

Supply of natural gas in Bangladesh from 2008-09 to 2020-21. Source: HCU

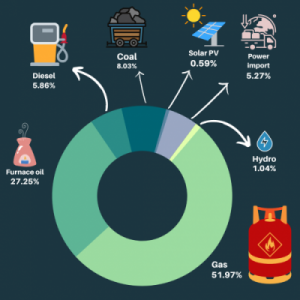

Source: Annual Report, BPDB, 2020-21

The second figure shows the power plants in Bangladesh as of 2020-21, disaggregated on the basis of the fuel they use. The heavy reliance on natural gas is clearly evident (52 percent).With gas production declining, the continued high dependency on gas in the power sector is a serious mistake. Approximately, 42 percent of the total gas supply goes into grid power generation.

For a long time, the Bangladesh Power Development Board (BPDB)has been relying on oil-fired power plants to meet the demand. Using oil-fired power plants means that the cost of electricity will go up. In the least-cost principle of electricity generation, planning oil-fired power plants should not enter the energy mix. If there is no other option, then roughly 20 percent of the power plants and 10 percent of generation can be from oil-fired power plants to essentially meet the peak demand. But in Bangladesh, we have been using oil-fired power plants for over 10 years for baseload power. This clearly shows that the government has not been able to build a sustainable power sector where uninterrupted electricity is available at affordable prices.

As soon as we realised that we were running out of gas, we should have planned for coal-based power plants. Even though more than 5,000MW of coal-fired power plants are in the pipeline, we have not been able to commission more than one 1,320MW power plant. The percentage of coal-based power plants being only eight percent is primarily due to the slow implementation of large-scale power plant projects. If these coal-fired power plants were available on time, the reliance on oil-fired power plants would have been less, and the present power crisis would be more manageable.

A major problem in Bangladesh’s power sector is that the BPDB has rarely ever consulted Bangladesh Oil, Gas and Mineral Corporation, also known as Petrobangla, before setting up a gas-fuelled power plant. In many instances, despite Petrobangla’s warning that they may not be able to ensure gas supply, the BPDB went ahead and allowed private companies to build power plants. This is highly irregular, because without primary fuel guarantee, it is not possible to get financing. The guarantee for fuel was given by the BPDB even though gas supply was Petrobangla’s responsibility.

After the discovery of the Bibiyana gas field, less than three trillion cubic feet (Tcf) of gas has been added to the 2P (proven+probable) reserves, but more than 10 Tcf of gas has been consumed. In the last five years, less than 0.5 Tcf of gas has been added to the reserves, but more than 3.5 Tcf has been consumed. Clearly, if we are to depend on gas as our main fuel, emphasis must be given on finding new reserves. Unfortunately, instead of emphasising on that, the domestic production of natural gas has been neglected. Bangladesh Petroleum Exploration and Production Company Ltd (Bapex) was not provided with sufficient funding to increase gas exploration.

More disturbing is the fact that almost nothing has been achieved on the deep offshore front. Of course, the offshore is an unknown region, but the government should have initiated a survey followed by drilling. But none of that has been done in the deep offshore region we won from Myanmar and India. All these point towards one thing: the government is more eager to import LNG than to find gas at home, which requires high-risk capital. Undoubtedly, the need for vigorous exploration is of paramount importance to avert a situation like the one we are in, or at least to lessen the impacts of supply disruption and price volatility.

Natural gas resource studies conducted by two reputed organisations from the US and Norway have indicated that there is a 50 percent probability of finding 32-40 Tcf of gas in Bangladesh – excluding the deep-sea region. We have found around five Tcf since the study was completed. Therefore, there are still good chances of finding more gas in the country. How then did Petrobangla come to the conclusion that there is no more gas in Bangladesh?