November 23, 2022

SINGAPORE – Rising inflation, higher interest rates and uncertain market conditions have hit the financial health of Singaporeans.

Unsecured debt levels have gone up and mortgage stress is mounting as more Singaporeans face difficulties in paying off their housing loans.

This is one of the findings of an OCBC survey done in August of 2,182 working adults between the ages of 21 and 65. The results were released on Tuesday.

The survey also found that while Singaporeans continued to be strong savers, they were not saving up for crises but were spending on discretionary expenses such as travel.

Coupled with poor investment returns, the OCBC Financial Wellness Index dipped to 61 from 62 in 2021.

Respondents were assessed based on 10 pillars of financial wellness, including saving habits, whether they plan for their retirement and whether they speculate excessively or spend beyond their means. The highest score was 100.

The Index was back at the level it was during 2020, when the world was grappling with the Covid-19 pandemic.

Debt stress levels increased as about a third of respondents (31 per cent) took on more unsecured debts such as credit card debts, education loans and renovation loans, up from 24 per cent in 2021.

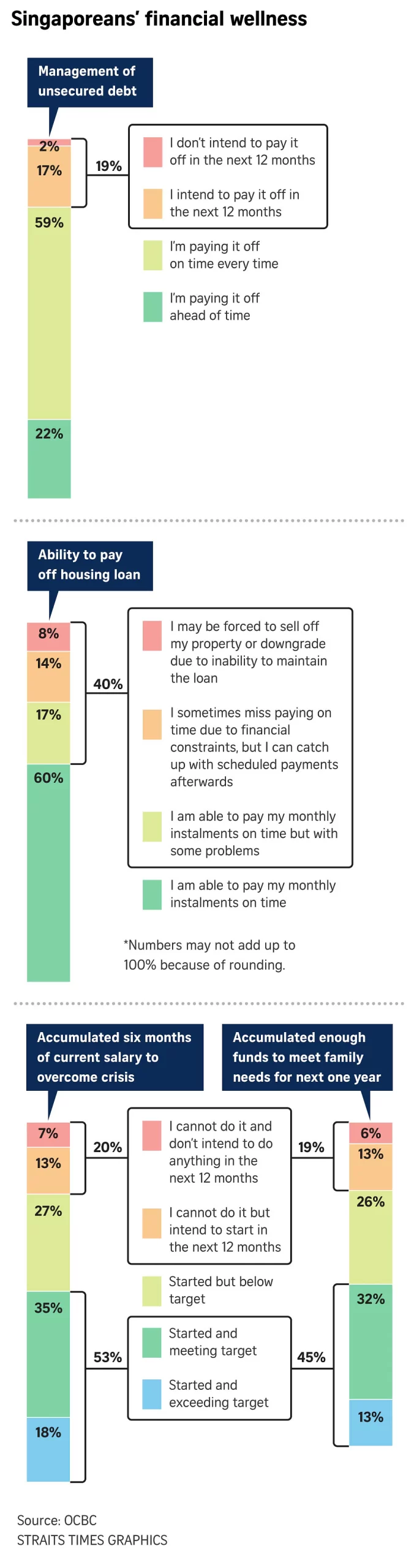

Their ability to repay unsecured debts also dropped three percentage points, with 19 per cent of Singaporeans having some difficulties managing these debts.

As mortgage rates pushed to as high as 4.5 per cent, 40 per cent of respondents now faced difficulties paying their housing loans, and more of them indicated they would have to sell or downgrade their homes to repay their loans (8 per cent, compared with 6 per cent in 2021).

OCBC said this 40 per cent was the highest proportion it had seen in the last four years.

Mr Chin Mun Hong, OCBC’s head of market insights, said mortgage stress is set to go up significantly more as home loan packages which were fixed at lower rates previously expire in the coming months and home owners have to take up packages at relatively higher loan rates.

Ms Lee Meng, executive financial services consultant at Gen Financial Advisory, said her clients are stressed from not knowing when interest rates will stop rising, adding that this uncertainty makes it difficult for them to budget their household expenses.

Among HDB and private property owners, OCBC said those who had HDB flats were slightly more stressed over their home loan, with 42 per cent facing difficulties versus 36 per cent for private property owners.

OCBC said many HDB home owners also took advantage of very low interest rates in the past decade to borrow from banks to finance their flat, hence they must now face up or have already faced up to higher rates when their loan packages expired.

But even as debt stress levels rose, Singaporeans were not saving enough for emergencies – 20 per cent had not accumulated six months of their current salary.

Financial advisers generally advise individuals to have a contingency fund of three to six months’ worth of salary to deal with family crises or emergencies.

Instead, the survey found that more Singaporeans were allocating their savings to discretionary expenses such as travel as the post-pandemic recovery spurs “revenge travel and spending”.

At the same time, investment returns had been disappointing, with the average rate of return on investments falling by more than half from 1.5 per cent in 2021 to 0.7 per cent this year.

More respondents also incurred investment losses this year – 36 per cent, compared with 26 per cent in 2021.

This meant that fewer Singaporeans were on track to meet their investment targets – 41 per cent versus 52 per cent in 2021, a fall of 11 percentage points.

Mr Sani Hamid, director of economics and market strategy at Financial Alliance, said despite this setback, investors should continue to invest for the long term by doing dollar-cost averaging. This is a strategy where they invest a fixed amount of money at regular intervals, say over a 24-month period, regardless of the price of the stock or investment.

In this inflationary environment, where returns are low, respondents are seeking more ways to build up their retirement nest eggs.

Across the age groups, more are taking on greater risks in their investments to earn higher returns.

The survey found that among those in their 20s and 30s, 33 per cent speculated excessively, while 36 per cent of those between 40 and 54 years old, and 34 per cent of those who were 55 to 65 years old, did so.

The older groups tended to speculate more in futures, currencies and structured investment products, which are financial instruments whose returns are linked to an underlying asset class such as equities, commodities or currencies.

Meanwhile, the younger respondents – Gen Zs and millennials in their 20s and 30s (about two in five of the respondents) – continued to turn to cryptocurrencies to build their retirement funds despite losing 40 per cent on average from such investments.

Ms Lee said unregulated assets such as cryptocurrencies should form at most only 10 per cent of a retirement portfolio.

Mr Sani said this is really not the time to be taking on too much risks as the markets are undergoing a reset. “We are not sure when it will end but until it does, there is going to be a lot of volatility”, he said.

Eighteen per cent of respondents in their 20s and 14 per cent of those in their 30s are currently invested in cryptocurrencies.

To ensure they remain financially healthy, OCBC head of wealth advisory Aaron Chwee advises everyone to save regularly, spend prudently, within their means and get adequate insurance coverage to take care of any unexpected health crisis.