May 26, 2023

DHAKA – An increase in property tax is needed to curb rapid wealth accumulation and rising inequality as the rate in Bangladesh is one of the lowest in the world, said the Centre for Policy Dialogue (CPD) and analysts yesterday.

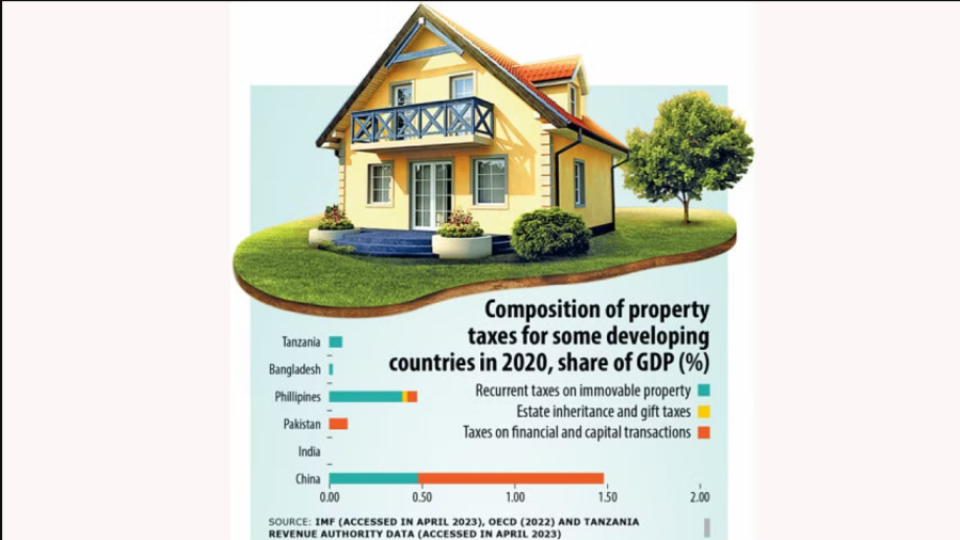

The property tax, which is collected in the form of land taxes and stamp duties, accounts for 0.27 per cent of the of Bangladesh’s gross domestic product (GDP), close to the average in African countries.

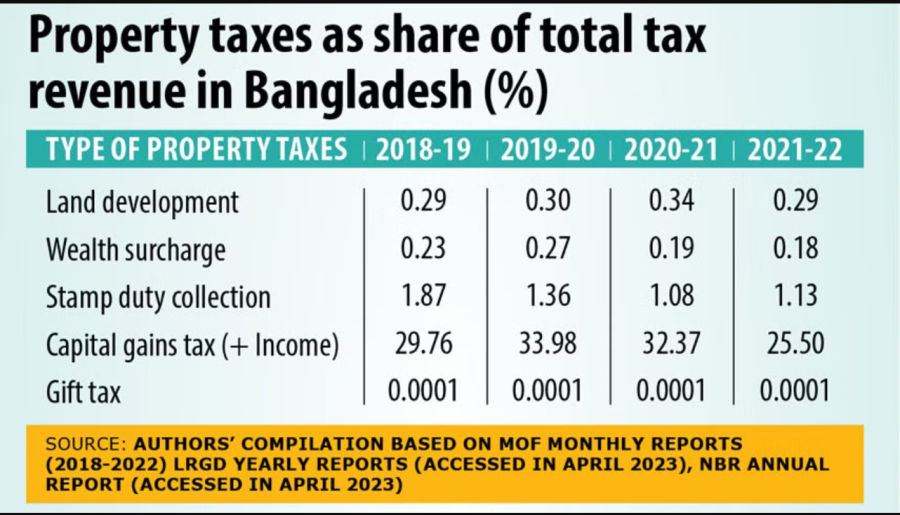

In the overall revenue collection, the share of property tax has been constantly declining for the last five years. In 2021-22, it made up about 5 per cent of the total direct tax raised by the Internal Resources Division and other agencies.

The amount of tax generated from properties, mainly land, is supposed to increase in line with the growth of the economy: if the GDP per capita of a country goes up by one per cent, the property tax as a percentage of GDP should increase by 0.47 per cent.

“An additional Tk 6,000 crore were supposed to come in the form of property taxes. We have not got that,” said CPD Distinguished Fellow Debapriya Bhattacharya while presenting the findings of a study on property taxes in Bangladesh at a dialogue.

The think-tank organised the event at the Lakeshore Hotel in Dhaka to discuss the findings of the study, supported by the European Union, on the limitations and opportunities for collecting property taxes.

Property tax is an important source of revenue for Organisation for Economic Co-operation and Development countries after income tax, value-added tax and excise duties.

More than 10 per cent of the total tax revenue came from the property tax in 2021 in Australia, Canada, the United Kingdom and the United States, whereas it constituted only 0.24 per cent in Bangladesh, Bhattacharya said.

“Collection of property tax should increase keeping pace with the economic advancement of a country. The higher the income growth, the higher the property tax.”

Citing rising income and wealth inequality in Bangladesh, the noted economist said wealth accumulation per adult increased by 3.66 times between 1995 and 2021 compared to the 1.41 times increase when it comes to income.

“This justifies the need to focus on wealth taxation more than income taxation. Income inequality has constantly been on the rise over the decades. This indicates higher potential for wealth tax collection in comparison to income tax.”

Bangladesh has one of lowest tax-GDP ratios globally and 68 per cent of its revenue comes from the indirect tax, VAT and customs duties.

Bhattacharya expects with Bangladesh’s transition from the category of the least-developed countries, the income level and wealth accumulation will increase, so the property tax has to be the potential source of revenue.

As such, he suggested collecting land development tax, and stamp duties based on the market value of land instead of the official rate, which is below the actual transaction value of land and properties.

Bhattacharya also recommended an introduction of inheritance tax as a new source of direct taxes.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said wealth inequality is rising in the country as the prices of land and flats are increasing.

In the absence of property tax, investment in real estate is increasing and land owners have been holding the properties for years without doing anything on the land, fueling prices and enhancing wealth accumulation.

“This is completely a tax haven,” Mansur said, giving the examples of Saudi Arabia and the United Arab Emirates, which impose heavy taxes if land is left unused.

Mansur, a former economist at the International Monetary Fund, gave the example of the Dhaka Purbachal area, saying land has remained empty miles after miles at a time when Dhaka requires 30 lakh houses to meet the demand for accommodation.

“As a result, the rent in the slums per square foot is higher than in the Gulshan area. The poorest of the poor are paying for this. So, if we really want to ensure affordable housing and curb wealth accumulation, wealth tax is necessary.”

“Wealth is accumulated without tax. It is a perpetuation of inequality.”

Maurizio Cian, head of cooperation at the Delegation of the European Union to Bangladesh, said property tax reduces inequality and makes it progressive.

“This tax is growth-friendly as it puts assets into motion,” he said, adding that property tax accounts for 2.2 per cent of GDP in the EU.

According to Cian, Bangladesh has to reduce customs tariffs to comply with World Trade Organisation rules and it is a good case to impose taxes on immovable properties.

Former NBR Chairman Muhammad Abdul Mazid said transfer of assets based on the mouza rate instead of the existing market value creates a lot of undeclared incomes.

“Property transfer is a major source of undeclared income and this needs to be addressed.”

Snehasish Barua, a partner at Snehasish Mahmud & Co, said only one-third of the actual value of property transfer is reported.

“Transaction-based mouza rate creates undeclared wealth. The person who buys properties is paying a low surcharge while another person legalises undeclared wealth. A vicious cycle has been created,” he said, recommending an inheritance tax.

Land Minister Saifuzzaman Chowdhury said it is high time Bangladesh collected higher tax from properties and inheritance taxes as the country is going to exit the LDC group.

“But we can’t change anything overnight. We need to do this keeping people in their comfort zone.”

Chowdhury said the government is setting up a database to ascertain the ownership of lands in order to curb tax evasion.

“We are working to create a land bank. We are going to introduce a system of land ownership certificates. We will issue smart cards that will contain land-related information.”

The minister said many people show non-agricultural land as farmland to evade paying higher taxes. “The land ownership certificate will be helpful in curbing the practice.”

Former NBR Chairman Nasiruddin Ahmed placed importance on automation and governance.

Shameem Haider Patwary, a lawmaker from the Jatiya Party, alleged that people have to pay bribes at land offices. They also feel discouraged to pay taxes for the absence of democracy and good governance, he said.