December 19, 2022

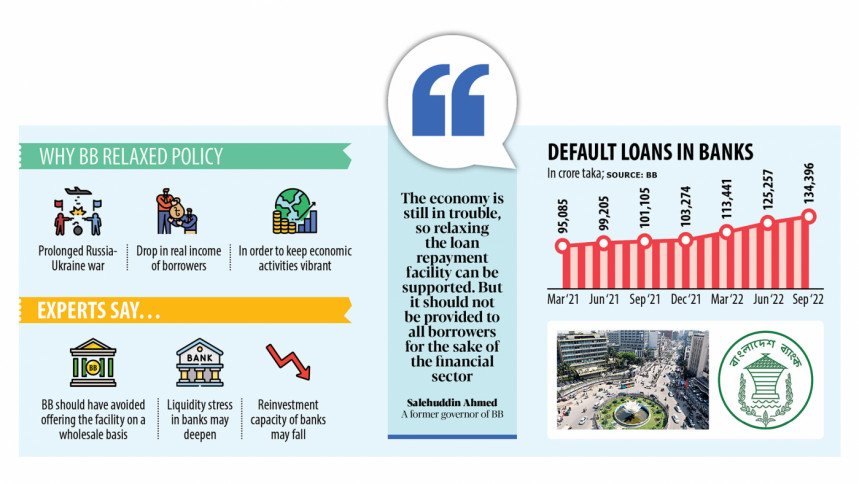

DHAKA – The Bangladesh Bank yesterday relaxed its already flexible loan repayment policy, saying the real income of borrowers has fallen due to the severe impacts of the prolonged Russia-Ukraine war.

Now, borrowers will be allowed to avoid being classified as a defaulter if they clear 50 per cent of their instalments payable in the final quarter of 2022 instead of 75 per cent previously, according to a notice of the central bank.

Insiders expressed their worries that the relaxed policy would deepen the liquidity stress in the banking sector as lenders will not get back the expected amount of funds from borrowers.

Banks in Bangladesh are already struggling to mobilise deposits owing to the negative returns on savings for the higher inflation and erosion of confidence among savers after loan-related scams recently left them upset.

The relaxed policy will be applicable for borrowers who took term loans, whose repayment tenure is more than one year, said the notice.

The central bank says the cost of industrial production has surged in recent times due to the war since the conflict has driven up the commodity prices in the global market.

“For this reason, the real income of borrowers has decreased,” the BB said, adding that the relaxed facility will help keep economic activities vibrant and make paying instalments easy for borrowers.

In June, the central bank said borrowers in large industries would be able to avoid falling into the default loan category by repaying half of the loans payable for the April-June period.

As per the previous circular, borrowers must clear 60 per cent of their unpaid loans due in the July-September quarter and 75 per cent in the fourth quarter of 2022 if they don’t want to be classified as defaulters.

The latest extension came less than a week after the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), the country’s apex trade body, pressed for a relaxed loan classification policy until June next year.

Borrowers enjoyed a full-year payment holiday throughout 2020 because of the coronavirus pandemic and could avoid slipping into the defaulter category by paying 15 per cent of the instalments payable for 2021.

The central bank discontinued the support from the beginning of 2022 as Covid-19 caseloads plummeted, paving the way for the economy to rebound strongly, before coming under pressure after the Russian-Ukraine war began.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, thinks the central bank has relaxed the facility further to entertain the FBCCI’s demand.

“However, the central bank should have handed over the responsibility to banks to decide which default borrowers would be eligible for the facility and which would not.”

Default loans in the banking sector may increase further once the relaxed facility is withdrawn.

Bad loans hit a record Tk 134,396 crore in September when such loans accounted for 9.36 per cent of the total outstanding loans of Tk 1,436,200 crore in the banking industry, BB data showed. A year earlier, the ratio was 8.12 per cent.

The loan repayment rules were relaxed at a time when banks are facing a liquidity crisis due to the shortage of loanable funds.

If borrowers pay their instalments partially, the ongoing fund shortage will deepen further, said the managing directors of two banks.

The commoners are shying away from keeping funds with banks in some cases as their confidence level has dipped, creating a difficult situation for lenders, they said.

“Willful defaulters may cash in on the facility,” said one of them, adding that good borrowers usually try to repay loans on time despite any relaxation policy.

Salehuddin Ahmed, a former governor of the BB, is against offering a relaxed facility on a wholesale basis.

“The economy is still in trouble, so relaxing the loan repayment facility can be supported. But it should not be provided to all borrowers for the sake of the financial sector,” he said.

“Only small and medium-sized borrowers should have been allowed to enjoy the relaxed facility.”

In recent times, the deposit growth in banks has slowed as many people saw their capacity to save dwindle amid the higher cost of living.

After touching a 10-year high at 9.52 per cent in August, inflation eased in the last three months. In November, it stood at 8.85 per cent.

But central bank data showed that the weighted average rate of interest on deposits was 4.13 per cent in the July-September quarter.