April 7, 2022

DHAKA – Macroeconomic stability, fiscal and debt management, and domestic resource mobilisation are the major areas Bangladesh need to keep its focus on, Asian Development Bank officials said yesterday referring to what the country can learn from the ongoing economic crisis in Sri Lanka.

They noted that Bangladesh has so far managed these issues well.

The officials were addressing a virtual press conference on the occasion of the release of the ADB’s annual flagship publication, “Asian Development Outlook (ADO) 2022”.

In its report, the ADB revised up the gross domestic product (GDP) forecast for Bangladesh this fiscal year to 6.9 percent from 6.8 percent.

In September last year, the ADB in its “Asian Development Outlook 2021 Update”

projected that the country’s economy would grow by 6.8 percent.

In fiscal 2021, Bangladesh’s GDP growth was 6.9 percent.

“GDP is projected to continue to grow strongly at 6.9 percent in FY22 on stepped-up budget spending, a strong expansion in exports and slight improvement in agricultural output,” it stated.

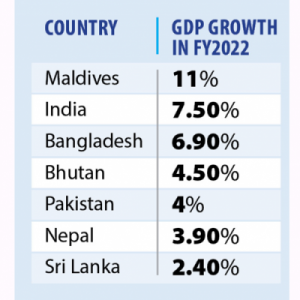

As per the projection for FY22, Bangladesh’s GDP growth rate is the third highest among the South Asian countries. The Maldives sits at the top of the list with a growth rate of 11 percent, followed by India with 7.5 percent.

The projection for Bhutan is 4.5 percent, Pakistan 4 percent, Nepal 3.9 percent and for Sri Lanka 2.4 percent.

Addressing the conference, ADB Country Director Edimon Ginting said Bangladesh’s GDP growth will be close to the South Asian average growth of 7 percent in FY22.

Replying to a query on what Bangladesh should learn from the ongoing economic crisis in Sri Lanka, Ginting said that usually, crisis does not arise all of a sudden, it happens for following substandard policies one after another.

He noted that it’s always good to look closely at policies and correct the incorrect ones as early as possible.

Referring to Bangladesh, the ADB country director said, “Debt management is very good here… I think the size of debt is not big, and most of the debt now is actually long-term and concessional in nature.”

If debt is managed well, the risk will be lower, he pointed out.

Ginting also put emphasis on domestic resource mobilisation.

He further said that the country, which has a steady and large flow of revenue, will be more resilient to external shocks.

ADB Senior Economist Soon Chan Hong said the Russia-Ukraine conflict has heightened uncertainty and unsettled commodity markets.

He said they think the direct impact of the war would be limited for Bangladesh, which doesn’t have that much trade with Russia and Ukraine as of now.

The economist, however, hinted that the indirect impact of the war would be high for Bangladesh.

In terms of export, Europe is one of the important markets for Bangladesh. If the war lingers on, the global economy, especially the Eastern European economy, will be hit hard, and Bangladesh will be affected as a result of that, he noted.

Oil, gas and commodity prices will continue to rise if the war goes on for long, he said.

Hong, however, said, “As of now, it is quite difficult to say… The war is raging on and we are seeing developments every day.”

The ADB would monitor the situation and assess its impact on Bangladesh, he added.