September 5, 2025

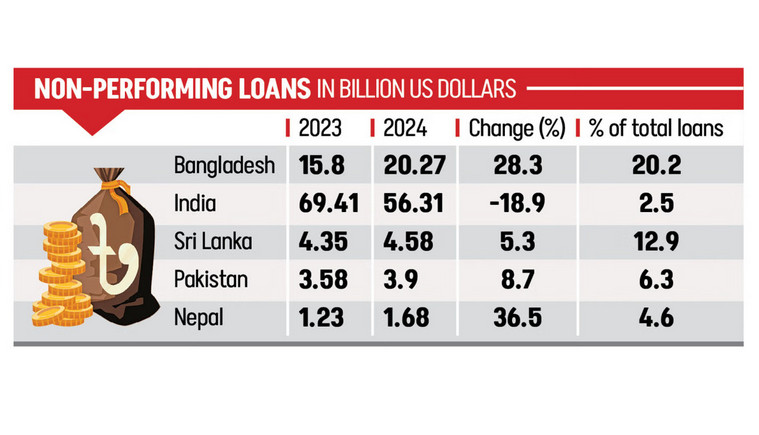

DHAKA – Bangladesh now has the highest non-performing loan (NPL) ratio in Asia, with defaults surging to 20.2 percent of total loans in 2024, according to a new Asian Development Bank report.

The $20.27 billion stock of distressed assets marked a 28 percent jump year-on-year, underscoring that Bangladesh has the region’s “most fragile banking system”, said the report titled Nonperforming Loans Watch in Asia 2025 and published last month.

“Bangladesh stood out as a regional outlier,” it said, adding that the country’s NPL ratio rose by 11.2 percentage points in just one year.

In contrast, other South Asian countries — India, Pakistan, and Sri Lanka — reduced their NPL ratios last year, while Nepal recorded only a marginal increase of 0.9 percentage points. India, the region’s largest economy, cut its NPL ratio to 2.5 percent from 3.4 percent, helped by sweeping banking reforms.

According to the ADB, the five South Asian countries collectively accounted for $86.74 billion in NPLs in 2023, which was 12.4 percent of Asia’s total, marking a decline from the previous year.

Bangladesh stood out for its worsening trend, with default loans rising to $15.80 billion in 2023. Its NPL ratio steadily mounted over the last five years, climbing from 7.7 percent in 2020 to 9 percent in 2023.

GRAPHICS: THE DAILY STAR

The ADB said this pointed to structural weaknesses in credit underwriting and resolution.

Economists attributed the surge to years of regulatory laxity, political interference, and the legacy of the past government.

They noted that loan classification rules had long been relaxed under political pressure, masking the true scale of defaults. The Bangladesh Bank has recently begun disclosing the actual picture, which, they warned, means the reported volume of bad loans is likely to rise further.

Zahid Hussain, former lead economist of the World Bank’s Dhaka office, said that before the political changeover in 2024, loan classification rules were kept relatively lax. The previous government repeatedly rescheduled loans of large conglomerates, masking the true extent of defaults.

He added that Bangladesh Bank also withheld the actual picture of distressed assets. “The situation has now shifted, with the central bank beginning to disclose the real state of non-performing loans. But as loan classification rules tighten, the reported volume of bad loans will likely rise further,” he told The Daily Star.

Citing India’s example, Hussain noted that while it once struggled with a mountain of bad loans, sweeping banking reforms helped bring defaults under control.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), also cited India as an example, saying the country managed to bring the situation under control through strict enforcement of rules and regulations.

In Bangladesh, he said, the banking sector saw a notable shift after the new governor took office at Bangladesh Bank.

He added that even Nepal now manages its loan portfolios better than Bangladesh, while the governance structures in Sri Lanka and even Pakistan are comparatively stronger.

Raihan also said that under the previous government, classification criteria were repeatedly altered to understate defaults, while politically connected business groups borrowed heavily — some of them fugitives or embroiled in corruption.

“I’m not sure if all of their loans have been classified as defaults yet,” Raihan warned. “But if they fail to repay properly, the volume of bad loans will rise even more.”

GRAPHICS: THE DAILY STAR

WHAT CAN BE DONE

Raihan argued that reforms must continue and go beyond the central bank, requiring stronger laws, better coordination across ministries, and above all protection from political interference. “The next elected government must be fully committed to carrying these reforms forward,” he said.

The ADB report said Asia’s NPL market has seen remarkable progress in recent years, but it remains crucial to prepare for potential downside scenarios. “Progress has been uneven across countries, underscoring the need for tailored approaches to NPL management,” it said.

The report warned that a prolonged global slowdown, exacerbated by trade disputes and geopolitical conflicts, could trigger new waves of NPLs in Asia, especially in highly leveraged corporate sectors and economies reliant on external trade and commodity exports.

To navigate these challenges, it suggested strong regulatory frameworks, efficient market structures, and proactive policy interventions.

The ADB said continued efforts to enhance judicial efficiency, improve market transparency, and foster investor participation will be key to developing a more effective and integrated secondary NPL market across Asia.