August 29, 2022

PHNOM PENH – With rising funding costs, stiff competition for deposits and growing interest rates on loans, can the sector produce a win-win solution for all parties?

Funding costs for banks and financial institutions in Cambodia are expected to rise in the second half of this year going into 2023 as the US Federal Reserve tightens its monetary policy.

Gentle ripples of inflation in the banking sector are starting to show as interest rates inch up in Cambodia, reflecting the uptick in the Fed’s interest rates, which ranges between 2.25 per cent and 2.5 per cent.

Additional hikes by the US central bank are expected this year, albeit in a smaller quantum, Reuters wrote quoting results of a poll on economists recently.

There is no policy rate guidance by the National Bank of Cambodia (NBC) to the banking sector, given its limited space to influence money supply and interest rates in a highly-dollarised economy, which was over 80 per cent last year.

However, it has continuously administered macroeconomic measures to control the inflation rate in the country.

In the midst, banks and microfinance institutions (MFIs) have raised interest rates for deposits by 0.5 to one per cent, to attract depositors, presumably to shore up internal funds, as overseas funding cost rose.

According to Kaing Tongngy, spokesman for Cambodia Microfinance Association (CMA), the interest rate increase is seen as a boost for Cambodians to deposit their cash with banks and MDIs.

This increase is expected to show in deposit interest rates, which he said is likely to push up operation cost of banks and MFIs, but he assured that a “significant” rise in loan and credit interest is not anticipated as yet.

Currently, MFI loan interest rates range from nine to 18 per cent per year while MDI (microfinance deposit-taking institutions) deposit rates are from five to 10 per cent depending on currencies, deposit term and other conditions.

He said CMA members are committed to support their clients who are recovering from the Covid-19 impact by keeping the same interest rates for loans and credit, regardless of the higher funding cost.

“For now, we are willing to absorb the additional cost, and we hope this will help our customers grow their business well,” he told The Post.

Valiant yet inevitable, Asia Pacific banks are however not likely to experience an impact from the Fed’s rate hikes for the moment. In fact, it may lift their net interest margins, according to Fitch Ratings earlier this month.

It said asset-quality exposures appear “well-contained”, but there could still be risks after a long period of supportive monetary policy that has contributed to rising leverage and asset prices in many markets.

It further mentioned that no significant deterioration in asset quality in any APAC banking sector is expected, though there may be “pockets of vulnerability”.

“This partly reflects our expectations for relatively moderate tightening across APAC, where inflation pressure is generally more subdued than in other regions,” Fitch Ratings said.

Lending rises, NCD dips

To be sure, capital levels and liquidity coverage ratio (LCR) of the banking sector, the latter a measure ascertaining a bank’s high-quality liquid assets survive a 30-day liquidity stress, has been stable as of June 30, 2022.

Commercial banks’ LCR was 146 per cent (benchmark 100 per cent) whereas MDIs – while above the threshold – fell to 150 per cent from 240 per cent from 2020 (full year) due to credit demand growth as Covid-19 restrictions eased, NBC said.

In addition, banks’ assets value was up 16.3 per cent at $64.6 billion while MFIs’ rose 23.4 per cent to $10.1 billion, compared to the first half of 2021.

For these two banking segments, customer deposits itself made up over 50 per cent of their funding source, respectively, whereas the source of funds for MFIs was backed by 60 per cent of local and foreign borrowings.

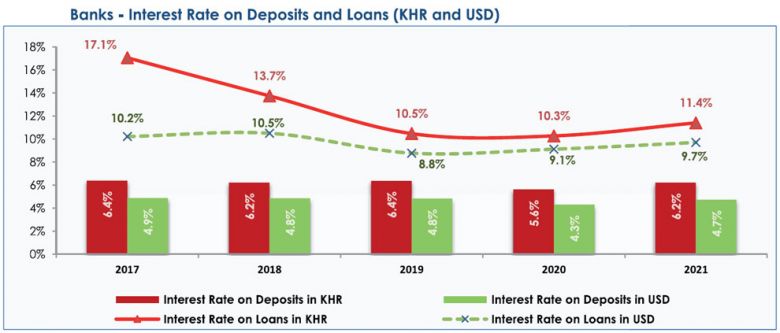

Source: Annual Supervision Report 2021 (NBC)

But stiff competition for customer deposits and savings (where banks clamour to offer the best interest rates), high borrowing interest rates from overseas financial markets and inflation remain as risks on the banking sector going forward.

In the meantime, liquidity in the banking system has been steady with the issuance of USD and Khmer short-term interest instrument, negotiable certificate of deposit (NCD) for banks to earn interest by investing their excess liquidity, as well as riel lending to banks via liquidity-providing collateralised operation (LPCO).

But, the pace of NCD issuance in the first half of 2022 has slowed year-on-year, possibly due to strong credit growth as economic activity improved, the NBC suggested.

Compared to NCD in riel which rose 24.3 per cent to 8.4 trillion riel ($2.05 billion) from last year, NCDs in USD dipped 1.2 per cent to $14.9 billion.

In its 2022 mid-year report, NBC said dollar-denominated NCD interest rates rose “significantly” for all loans after using SOFR (secured overnight financing rate) instead of LIBOR (London interbank offered rate) because of Fed’s rate hikes.

Although the dip in USD NCDs is negligible, what it indicates is that banks might be forestalling the possible impacts from higher interest rates, observed an industry expert, adding that banks are probably using their funds to provide credit instead.

“That is right,” confirmed In Channy, president and group managing director of Acleda Bank Plc, Cambodia’s largest commercial bank in terms of total asset value.

He explained that the subscription of NCD is incumbent on the availability of short-term surplus funds but since the relaxation of Covid-19 restrictions, bank lending to customers has “significantly increased”.

“Since then, the bank has effectively managed its liquidity to fund the business growth according to the growth trend of the banking sector as a whole. The NCD subscription has therefore declined in terms of amount and term,” he said.

The increased USD NCD rates are in tandem with international rates, which are on an upward trend largely in response to increased levels on inflation, said Raymond Sia, chairman of Association of Banks in Cambodia (ABC).

But emphasis is being placed on the usage of the riel by the NBC, which is strongly supported by ABC members, he said.

Last year, the NBC injected about $591 million to stabilise the exchange rate (4,099 riel per USD on average) to protect the purchasing power of the riel against the dollar.

Earlier this year, possibly before the war (which caused global inflation to spiral), the NBC relied on NCD and LPCO to keep the exchange rate and banking sector liquidity under control, and encourage riel circulation in the market.

NBC did not respond to questions.

Tad difficult

Inflation in Cambodia averaged at 6.5 per cent in the first half of 2022 compared to 3.5 per cent in the corresponding period last year, NBC’s mid-year report showed.

Yet, the impact of the inflation has not been much realised on the deposit rate of banks in Cambodia.

“[This is because] the [deposit] rate has already been driven up by competition in the banking market, and it [is] high enough to offset the impact of inflation,” said Channy.

These are competitive interest rates “demanded” by the market, and it is assumed that inflation is factored into the interest rate by depositors.

As for loan rates, Channy, who was speaking on behalf of his bank, said Acleda has partially borne the inflation cost.

“The full inflation amount could not be priced into the loan interest rate, owing to competition [among banks]. This factor have been reflected in the bank’s gradual decrease of net interest margin from year to year,” he commented.

So, while the increase in interest rates for termed deposits and savings is likely to benefit both banks and customers, the impact will nonetheless manifest on both sides of the balance sheet.

However, to balance it out, the rise in loan rate is deemed necessary to secure a margin of 1.

5 per cent to two per cent, which inadvertently would make it a tad difficult for borrowers since they may need to subsume the difference.

‘Vicious cycle’

Would high loan rates impact credit growth in the near-term? What about debt repayment, assuming global situations worsen? For Acleda, consolidated loan growth (USD and riel) was around 12 per cent as of June 30, 2022 compared to 2021, with USD loan growth at 10 per cent.

Source: Financial Stability Review 2021 (NBC)

At the same time, non-performing loan (NPL) ratio expanded to 2.4 per cent from 1.9 per cent as at end-December 2021 due to loan downgrades in accordance with NBC’s loan classification and provisioning prakas last December. Channy expects NPL ratio to improve to around two per cent at the end of 2022.

Overall, he portends a slow down in loan growth in both currency denominations in the second half of 2022 and into 2023 because of interest rate extensions on loans caused by high cost of funds.

Meanwhile, NBC economist Oudom Cheng opined that assuming domestic interest rates hike becomes palpable, it would further encumber the household and private sector, if global downside risks jostle Cambodia as predicted.

On one hand, it would mean facing prolonged elevated imported inflation, which would impede domestic consumption and investment, coupled with slower foreign demand for Cambodia’s exports. This, he said, could be a “vicious cycle” of burdensome repayment capacity for borrowers, leading to slower credit growth.

“On the other hand, Cambodia’s exports have been more diversified and have proven to be somewhat inelastic while tourism is partially determined by the control of Covid-19 recurrence within and outside of Cambodia.

“If this scenario could be maintained, and commensurate policy measures are introduced to support the domestic economy, the negative impact could be palliated,” Oudom said.

Insulated still?

Being a dollarised economy, there is a correlation and guidance that is taken from the direction of the US interest rates, ABC’s Sia said.

There are two major components to the level of interest rates, he explained. The first being the guidance from central banks on the setting interest rates, largely based on inflationary and deflationary direction. Secondly, the credit worthiness and inherent risk of the borrowing party or country in question.

As inflation has been rising over the past years, central banks around the world have started to increase interest rates, thereby placing pressure on Cambodian interest rates to move in tandem in a similar direction, he said.

In contrast to that, Cambodia´s sovereign risk level and overall credit or lending market risk have improved over the years due to the prudent measures put in place by the government and NBC.

“Notwithstanding the improved sovereign credit standing, interest rates have shown an upward trajectory,” Sia said, citing data shared by NBC in its 2021 Annual Supervision Report.

With current interest rate levels for deposits seemingly higher than inflation rate, the association does not anticipate real interest rates to be negative, adding that the risk of that happening is low.

Moving forward, he expects “encouraging” loan growth, albeit slower compared to previous years despite headwinds. Loan defaults may rise slightly, mainly due to the impact of the pandemic.

While the withdrawal of the Covid-19 loan restructuring moratorium would require banks to re-assess loans and make appropriate classifications or provisions to their loan portfolio, NPL levels would not be at a level that would place the industry at risk, he said.

All things considered, the association expects a stable outlook, assuring that the banking sector remains insulated from inflationary pressures, thanks to NBC’s measures over the last two years.