July 25, 2022

DHAKA – Bangladesh is now facing an “economic crisis” that will not be over soon as the global economy is also going through turmoil, economists said yesterday.

They urged the government to take more measures as the current ones taken to address the situation are inadequate.

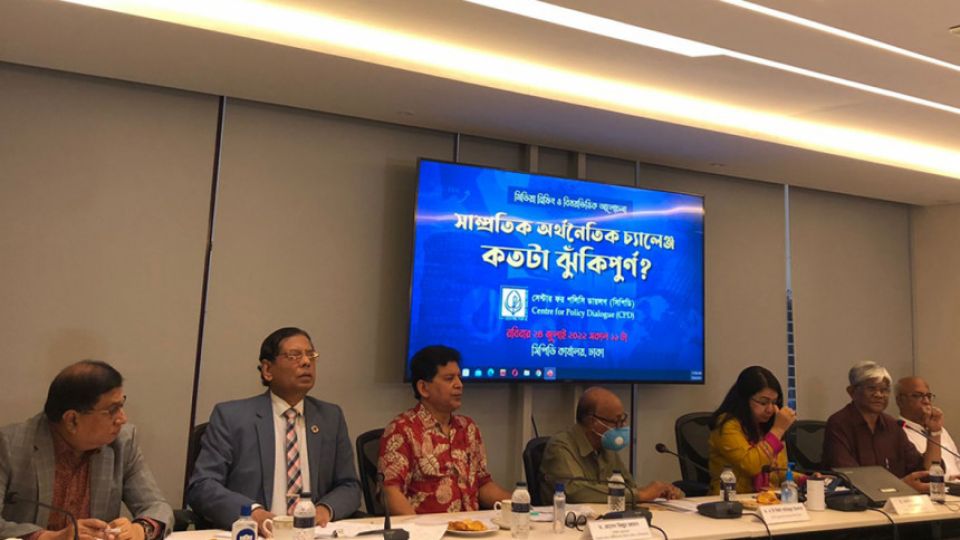

The crisis might ease once but at a slower pace, they said at a discussion on the recent economic challenges of Bangladesh, organised by the Centre for Policy Dialogue at its office in the capital.

The economists think the country should explore more gas to reduce over-reliance on imports to meet its energy demand and avoid quick rental power plants in order to tackle further troubles in the foreseeable future.

They suggested the government enhance the monitoring on imports to protect the forex reserves, and said tackling money laundering should be given emphasis.

Ensuring good governance in banks, withdrawing the lending interest rate cap of 9 percent and managing foreign loans from different sources to keep the reserves afloat were also among their recommendations.

Fahmida Khatun, executive director of the CPD, presented the key-note paper at the event, saying the price of almost every food item was increasing at a higher rate compared to the inflation rate unveiled by the Bangladesh Bureau of Statistics in June this year.

Inflation in Bangladesh reached 7.56 percent in June, which is the highest in nine years.

Rising inflation has a more adverse impact on people with lower income groups, so they need to be protected. Poor households should be provided with government supports, she also said.

To tackle inflation, the economist recommended, the central bank should increase the interest rate on loans to control the money supply to the market. She also suggested the government follow the ongoing austerity measures.

She thinks the high energy price is likely to continue in the global market in the coming days, which is why more foreign exchanges will be needed.

To check the declining trend of the ongoing foreign reserves, Fahmida said, the government should borrow from the Islamic Development Bank, International Monetary Fund and World Bank and foreign nations.

Last week, the country’s foreign exchange reserves stood at $39.67 billion, down from $46.15 billion in December last year.

Mohammad Tamim, a professor at the Bangladesh University of Engineering and Technology, said the country has hardly made any investment in recent years in exploring natural gas and coal.

“It [the government] relies on imports for the items to reduce the financial risks associated with exploration. This has created a risk for the supply and prices of energy products.”

The government had allowed setting up quick rental power plants by using petroleum to address the electricity crisis on the short-term basis. There was a decision that the plants would run for the period of three-five years, but they are still operating, he said.

Dependency on petroleum to generate electricity has created the existing crisis, said the energy expert and recommended putting focus on coal-based power production and renewable energy to meet energy demand.

Mustafizur Rahman, a distinguished fellow at the CPD, said the commoners could have avoided the inflationary pressure to some extent had the central bank depreciated the taka against the dollar gradually in the last five-six years.

The BB should continue the floating exchange rate of the taka, he said.

The exchange rate of the taka stood at Tk 94.45 per dollar on the inter-bank platform on Thursday.

On July 21 last year, the rate was Tk 84.80, which means there has been a 11.38 percent loss in value in a year.

Mustafizur Rahman said both the BB and the government should give efforts to stop money laundering in the name of exports and imports.

Salehuddin Ahmed, a former governor of the BB, said the central bank would not be able to bring stability in the foreign exchange market by injecting dollars consistently.

Rather, it should beef up its monitoring on import payments such that import of non-essential items could be arrested, he said.

Since the end of last year, import payments have been going up because of a rise in the prices of commodities in the global market, playing a major role in destabilising the economy.

Between July and May of last fiscal year, import payments went up by 39 percent year-on-year.

“The lack of corporate governance is a major challenge for the country’s banking sector. The vested quarter is now influencing the central bank’s decision,” he said.

Hossain Zillur Rahman, executive chairman of the Power and Participation Research Centre, said there is an “iron triangle” prevailing in the country’s economic governance.

The ” iron triangle” can be defined as a government that functions through connections between politicians, lobbyists (on behalf of business owners or interest groups), and bureaucrats.

Under the system, Hossain Zillur said, anomalies are getting shaped through the legal process. “The term of the mismanagement is not applicable for the current economic system. The economy is being driven by the conflict of interest.”

He also said, “We are proud of the country’s resilience. It is time to say goodbye to the resilience as the influential groups are enjoying outputs from such a situation. But the commoners have to bear the brunt.”

AB Mirza Azizul Islam, a former finance adviser to a caretaker government, said the government should give efforts to increase remittances with a view to resolving the forex crisis.

The inflow of remittance, the cheapest source of foreign currencies for Bangladesh, fell 15 percent year-on-year to $21.03 billion in fiscal year 2021-22.

Exporting human resources should be given priority to get back the tempo of remittances, he said.