July 27, 2023

TOKYO – The Group of Seven industrialized nations have begun detailed discussions toward reducing their reliance on imports of critical minerals from specific countries, with China in mind, Japanese government sources said.

Specifically, they will set targets for the level of dependence for minerals whose export is dominated by particular countries, and increase imports from other countries to eventually meet their goals.

The G7 countries also want to cooperate with each other to diversify their supply systems.

Critical minerals are indispensable for a green transition, as they are used in electric vehicles, solar panels, storage batteries and other devices that play crucial roles in economic activities. Their supply sources have been concentrated in certain countries, including China. Japan has designated 35 minerals — including lithium, nickel and cobalt — as critical minerals to be stockpiled.

Economic security was a key agenda item at the G7 Hiroshima Summit in May, and the leaders agreed to cut reliance on China for critical minerals. Their communique states that “we invite the International Energy Agency (IEA) to make recommendations by the end of this year on options how to diversify the supplies of energy and critical minerals as well as clean energy manufacturing.”

The IEA is currently selecting critical minerals whose international sources should be diversified. It is to finalize the recommendations by the end of this year.

As a concrete measure to reduce overdependence, the G7 countries have considered joint investments in other resource-rich countries. Japan holds the G7 presidency this year and will aim to take the initiative on this issue.

According to 2021 statistics from the Japan Organization for Metals and Energy Security (JOGMEC), Japan imports 81% of its lithium — the sum of lithium oxide and lithium hydroxide — from China.

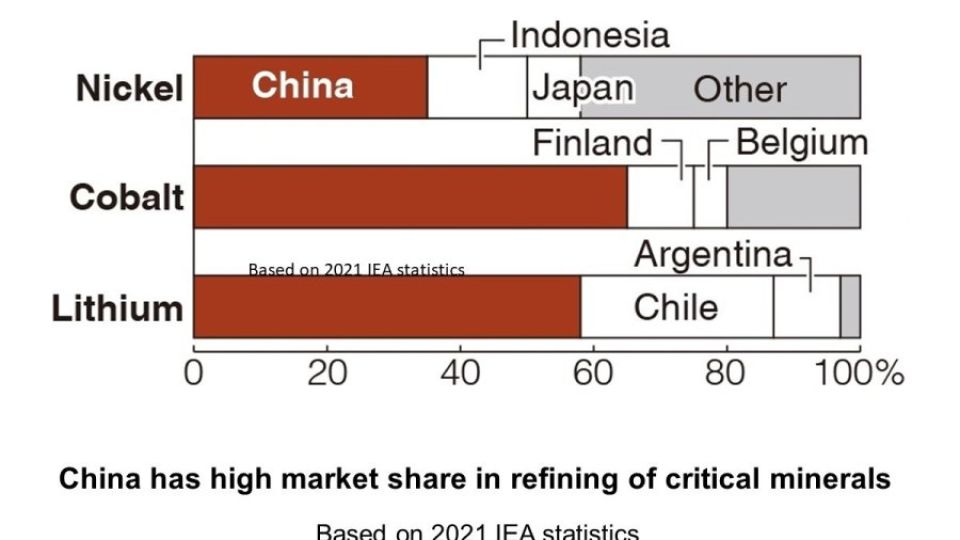

China has particular strength in processing and refining critical minerals. According to 2021 statistics from the IEA, China’s global market share in refining was 58% for lithium, 65% for cobalt and 35% for nickel.

China has repeatedly engaged in economic coercion by restricting trade with rival countries, leading the G7 countries to work together to reduce risks of overdependence by increasing their sourcing of critical minerals from other countries.