April 22, 2025

JAKARTA – Indonesia booked a large trade surplus in March thanks to surging exports to the United States before import tariffs introduced by US President Donald Trump took effect.

Data unveiled by Statistics Indonesia (BPS) in a press conference on Monday showed that last month’s trade balance, or total exports minus imports, amounted to a US$4.33 billion surplus, higher than the $3.1 billion surplus recorded in the preceding month.

March marked Indonesia’s “59th consecutive month” of trade surplus in a rally that began in May 2020, BPS head Amalia Adininggar Widyasanti explained, adding that bilateral trade with the US contributed most to positive net exports last month.

At $1.98 billion, Indonesia’s non-oil and gas trade surplus with the US in March was the highest logged in bilateral trade with the world’s largest economy since the $2 billion surplus in March 2022.

Shipments of electrical machinery and equipment alongside footwear and crude palm oil (CPO) were the commodities that contributed the most to the surplus with the US, Amalia said.

The BPS head disclosed that the US, the world’s largest consumer market, was Indonesia’s largest export destination for numerous goods. For instance, it absorbed 63 percent of certain apparel and accessories throughout this year’s first three months, while Japan, the next largest market, only bought 5.41 percent of the same goods.

Similarly, 34 percent of Indonesian footwear exports went to the US, while the next largest market was responsible for less than 10 percent.

CHART: THE JAKARTA POST; SOURCE: STATISTICS INDONESIA

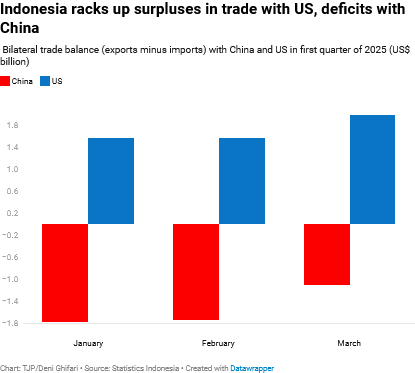

On the opposite end, China once again accounted for Indonesia’s largest bilateral trade deficit last month, as imports exceeded exports by $1.1 billion.

That was comparatively low when compared to deficits of $1.77 billion and $1.75 billion in January and February, respectively, with the world’s second-largest economy.

Read also: China warns countries against striking trade deals with US at its expense

March’s $4.33 billion national trade surplus exceeded most economists’ forecasts and in its extent was out of character, as domestic demand normally increases during the Ramadan and Idul Fitri holidays, driving up imports.

Imports did grow 5.34 percent year-on-year (yoy) in March, exceeding export growth of 3.16 percent yoy. However, the import growth was slower than the 6.6 percent forecast made by Fithra Faisal Hastiadi, an economist with SSI Research.

“The lower-than-expected import growth during Ramadan reflects sluggish domestic demand, indicating that pressure on household spending remains evident,” Fithra wrote in an analysis on Monday.

He went on to say that exports proved relatively resilient in March amid ongoing global economic uncertainties, including escalating trade tensions and weakening demand in many countries.

Bank Danamon economist Hosianna Evalita Situmorang wrote in an analysis on Monday that exporters had “accelerated shipments ahead of Trump’s” tariffs set for April.

She pointed out that freight bookings at China’ ports had plunged by 640,000 to 800,000 containers, reflecting “early spillover from trade tensions [that gained momentum] in March and blew up in April”.

Hosianna wrote that Indonesia’s outlook remains resilient but needs to be watched carefully as Jakarta is planning to increase imports from the US by $1.5 billion to $2 billion per month to placate Washington in tariff negotiations.

Read also: Indonesia, US seek new balance in tariff talks

However, “risks persist from higher US tariffs” on palm oil, as well as from coal prices sliding because of weakening global demand prompted by the trade war, the economist said.

She said Bank Indonesia’s accommodative stance and efforts to diversify export markets with a greater focus on ASEAN, India and Europe “should buffer external pressure”.

Bank Permata chief economist Josua Pardede told The Jakarta Post on Monday that the “preliminary assumption” might be to attribute Indonesia’s rising exports last month to exporters trying to ship out more goods before US tariffs kick in.

“However, that is yet to be verified, since there was a seasonal factor [at play as well,] with the post-Chinese New Year [period falling] in March,” Josua said.

He pointed out that March’s exports had been bolstered largely by iron and steel, a key export category for Indonesia, where shipments rose in both volumes and prices, presumably driven by Chinese industries stocking up on raw materials.

Exports of iron and steel grew almost 20 percent in the month of March and were up 12 percent yoy. CPO shipments also grew by 41 percent yoy, but coal exports plunged 23.14 percent yoy.

Indonesia’s trade surplus for the first quarter was $10.9 billion, far higher than the $7.41 billion in last year’s first quarter.