February 6, 2023

TOKYO – The Japanese tea industry is focusing on expanding overseas sales channels due to a decline in domestic consumption amid the novel coronavirus pandemic.

Major production areas, such as Kyoto Prefecture, are undertaking new initiatives in sales and production: In February last year, a seminar about Japanese tea was held in Hollywood, Calif. Akio Matsumoto, a sommelier at a Japanese restaurant in New York, explained to attendees from companies that operate local restaurants that new dining experiences can be offered by pairing a wide variety of Japanese teas with meals.

The seminar was organized by the Japan Food Product Overseas Promotion Center (JFOODO), which operates under the auspices of the Japan External Trade Organization (JETRO). Some 16 Japanese companies, including tea manufacturers from the major tea-producing prefectures of Kyoto, Shizuoka and Kagoshima, participated in the seminar. JFOODO also held the event in New York.

A JFOODO official said, “They [events] were a great opportunity in that we were able to spread the word about the high added value of Japanese tea.” Similar seminars are planned in the future to further expand overseas sales channels.

Consumption decline

The Yomiuri Shimbun

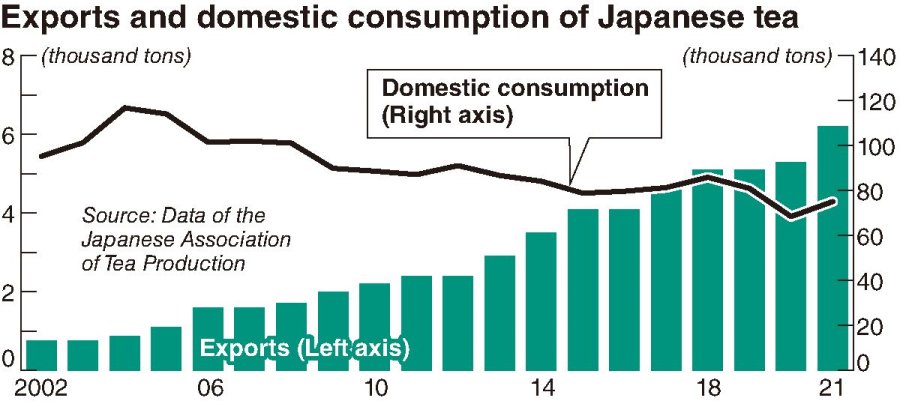

Domestic consumption of Japanese tea has been waning in recent years. According to the Japanese Association of Tea Production, consumption peaked at 117,000 tons in 2004 and has been on a downward trend since. In 2020, a drop in demand due to a lack of foreign visitors to Japan amid the coronavirus pandemic and the cancellation of tea ceremonies spurred a 15.5% year-on-year drop to about 68,000 tons. The figure rallied somewhat to about 75,000 tons in 2021, but this still only represents two-thirds of the peak level.

In contrast, exports are increasing. According to Finance Ministry trade statistics, exports in 2021 totaled 6,179 tons — a 160% increase from 2,387 tons in 2011 — while export value increased 330% to ¥20.4 billion. Volume and value both logged record highs.

This rapid growth is thought to be related to the growing global trend toward health consciousness. “The image of Japanese tea as being healthy is gaining ground, especially in Europe and the United States,” said Hirosaki University Prof. Satoshi Ishitsuka, an expert in agricultural economics.

People in the U.S. reportedly are increasingly drinking Japanese tea rather than alcoholic beverages, and many cafes in the U.S. — as well as Asia and Europe — have added matcha teas to their menus. Demand is expected to continue to grow. According to market research firm Global Information Inc., the global market for matcha alone was worth $2.75 billion in 2021 and is predicted to reach $4.28 billion in 2027.

Production increase

Moves to keep pace with overseas demand are gaining momentum in tea-producing regions. In 2019, high-end powdered green tea manufacturer Seicha Tsujiki added English explanatory text and an inquiry form to its website. The firm, based in Uji, Kyoto Prefecture, subsequently began receiving a steady stream of overseas inquiries, and exports now account for about 20% of the company’s shipments. Company President Kiyoharu Tsuji said: “Quality is highly valued, even if the price is a little steep. We’re keen to continue dispatching our high-quality products.”

The Chamber of Kyoto Prefecture Tea — an association of tea industry in Kyoto — and others developed a new product called Tamausagi in 2020, using only made-in-Uji gyokuro tea, high-grade Japanese tea produced through a special process. It is characterized by an aroma and umami that pairs well with Japanese food, which allows for wine-like enjoyment, according to the chamber. In addition to shipping within the prefecture, it exports to the United States and is also eyeing sending its products to Dubai.

Focusing on the overseas caffeine-free drinks market, Mie prefectural government has commercialized decaffeinated Isecha tea in collaboration with farmers.

Attempts are also afoot to leverage digital technology to improve production efficiency. Tea-producing firm Kitamoto Seicha En in Minami-Yamashiro, Kyoto Prefecture, has introduced a production management system that combines smartphones and drones that help reduce work hours.

“Introducing new systems to support producers, we will make more serious efforts to market our tea overseas as a whole industry,” said an official of the chamber.