December 12, 2024

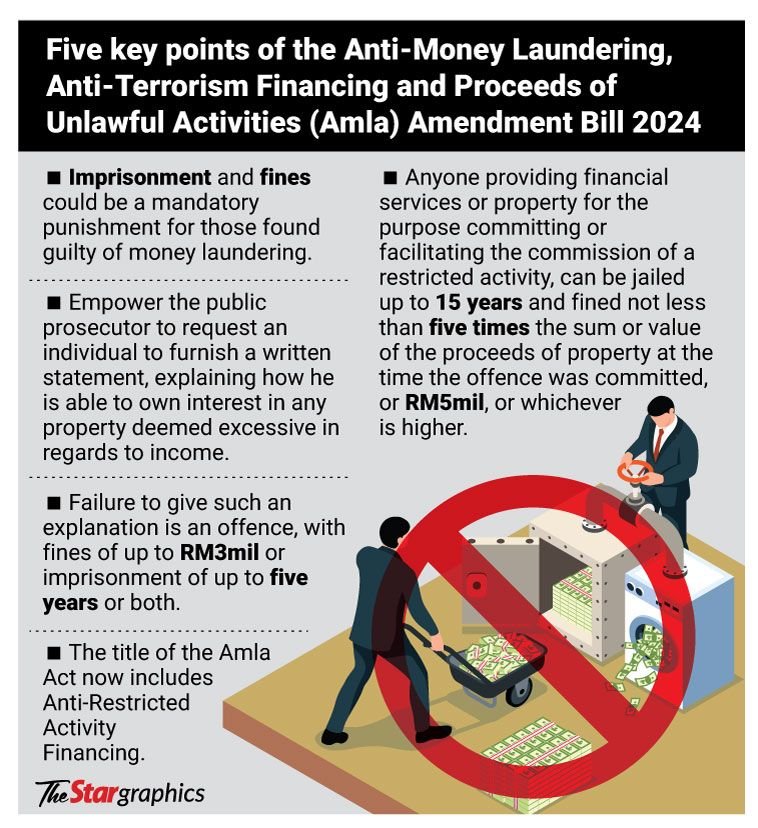

PETALING JAYA – Imprisonment and fines could become mandatory punishment for those found guilty of money laundering.

This is part of amendments to the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities (AMLA) Amendment Bill 2024 that was tabled and subsequently passed in Parliament yesterday.

The changes include fines as high as RM5mil for new offences.

The Bill, which contains 52 clauses, was tabled by Deputy Finance Minister Lim Hui Ying in Parliament for first reading on Monday.

The Bill’s main objective is to strengthen supervision and enforcement to prevent money laundering and terrorism financing.

ALSO READ: Lim: Changes crucial to meet international standards

Another key provision will compel individuals to account for excessive wealth.

The public prosecutor would be empowered to request an individual to furnish a written statement on oath or affirmation, explaining how he was able to own interest in any property deemed excessive in regard to the person’s income.

“Failure to give such an explanation is an offence,” the explanatory statement of the Bill read.

Any person who fails to give a satisfactory explanation will be liable to a fine not exceeding RM3mil, or imprisonment of not more than five years, or both, upon conviction.

ALSO READ: Amendments pose strong deterrent to launderers, say activists

Also proposed was a name change for the law to include Anti-Restricted Activity Financing.

With the inclusion, the law will be known as the Anti-Money Laundering, Anti-Terrorism Financing, Anti-Restricted Activity Financing and Proceeds of Unlawful Activities Act.

The Bill proposes a requirement for a reporting institution, or the director, officer, or employee of the reporting institution to keep a record of all domestic and international transactions or activities.

The Public Prosecutor will meanwhile be empowered to seize property that has been released if the property is the subject matter or evidence relating to the commission of an offence.

A third party who fails to attend court on the specified date will not be allowed from making any claims after a forfeiture order is made.

The Bill stated that it would be an offence for any person to directly or indirectly provide financial services or property knowing that it will be used for the purpose of committing or facilitating the commission of a restricted activity.

Those found guilty can be punished with imprisonment not more than 15 years, a fine not less than five times the sum or value of the proceeds of the property at the time the offence was committed, or RM5mil, or whichever is higher.

Relevant authorities would be empowered to conduct examinations on institutions under their supervision and examine any systems and records of the institution.

A person under examination will be required to cooperate by handing over any information and appearing before the authorities when told to do so.

“Any person who contravenes this commits an offence and shall, on conviction, be liable to a fine not exceeding RM3mil or imprisonment for a term not exceeding five years, or both.

“In the case of a continuing offence, shall in addition be liable to a fine not exceeding RM3,000 a day or part thereof during which the offence continues to be committed.”

Another proposed change is the removal of a current requirement to publish any notice, order or documents in newspapers.

The Bill also introduces a new section to empower the authorities to take administrative action for any contravention of the Act.

Any reporting institution or the director, officer or employee of the institution who fails to comply with the directive of the authorities, commits an offence.

They are upon conviction liable to a fine not exceeding RM1mil or imprisonment not more than three years, or both.

“In the case of a continuing offence, shall in addition be liable to a fine not exceeding RM3,000 a day or part thereof during which the offence continues to be committed,” the statement said.

GRAPHICS: THE STAR