May 29, 2025

PETALING JAYA – Malaysians are experiencing a heavy burden when it comes to rising food prices, with data showing that they spend more on groceries than any South-East Asian country.

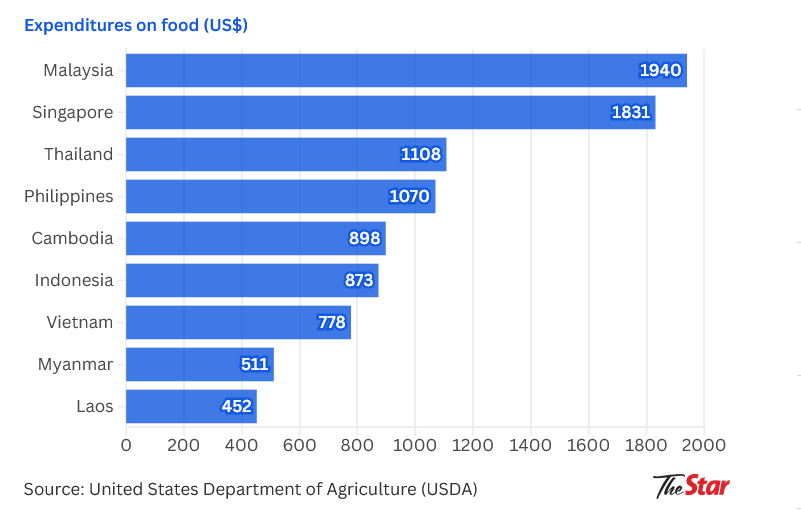

Data from the US Department of Agriculture (USDA) Economic Research Service shows that Malaysia’s consumer expenditure on food at home was highest in the region in 2023 at US$1,940 per person per year.

The USDA figures are not adjusted for inflation or differences in living costs between countries.

According to Bank Negara Malaysia’s exchange rate in 2023, the US$1,940 figure for Malaysia is equivalent to RM8,848.

However, at current exchange rates, it is equivalent to RM8,286.

Singapore was second at US$1,831, followed by Thailand (US$1,108), Philippines (US$1,070) and Cambodia (US$898).

Food expenditure in Asean countries, 2023

GRAPHICS: THE STAR

Experts said several factors explain why Malaysians spend a relatively high amount on food at home compared to other countries in the region.

They include a reliance on food imports, a weaker Ringgit and farm labour shortages.

Other reasons include the rising cost of input in food production such as fertilise and animal feed, monopolies and oligopolies in food production, as well as low farm productivity.

“Malaysia’s elevated food cost per person relative to its Asean counterparts points to the need for concerted efforts by the government and private sector to expand food production and raise farm productivity,” said Sunway University economics professor Dr Yeah Kim Leng.

He said other complementary actions include dismantling monopolies and liberalising food markets, reducing transport and storage costs and improving supply chain efficiencies to bring down food prices.

He said Malaysia’s higher food expenditure per person at home compared to Asean countries with lower per capita income can also be explained by its higher income level.

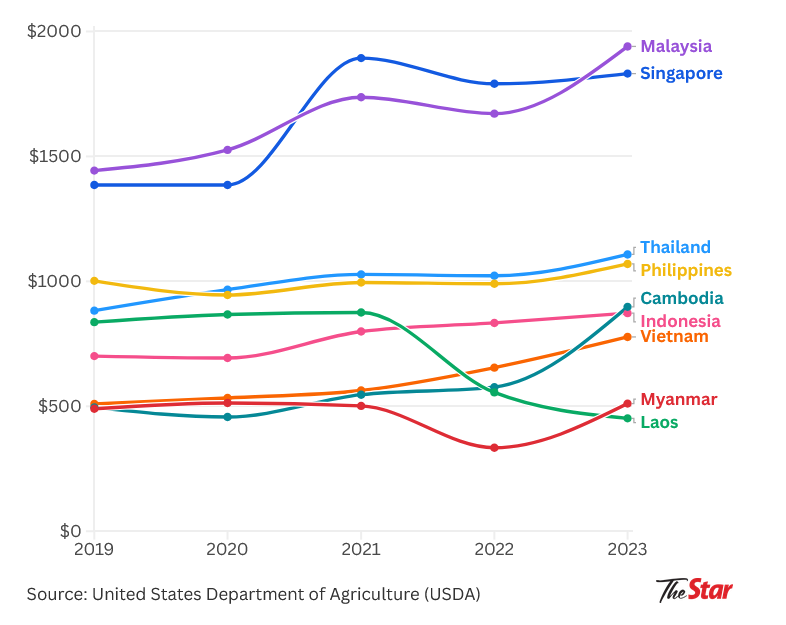

“However, despite income per capita that is in multiples that of Malaysia, Singapore’s food expenditure per capita is about the same as Malaysia’s during the 2017 to 2023 period, with the 2023 figure dipping below Malaysia’s in 2023,” he said.

Food at home expenditure in Asean, 2019-2023

GRAPHICS: THE STAR

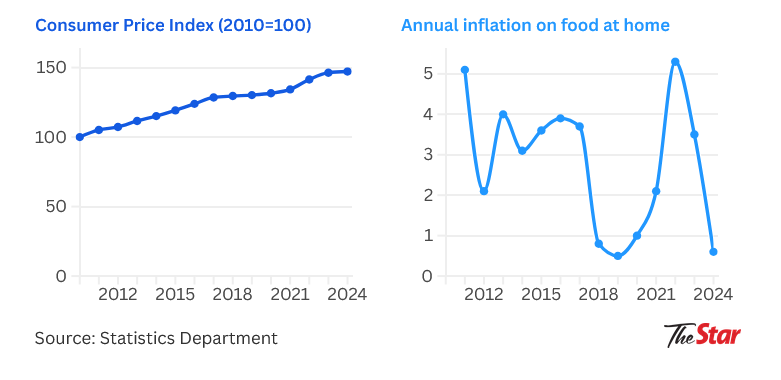

While the data specifically does not take inflation into account, Yeah noted that the food component in Malaysia’s consumer price index (CPI) basket has been experiencing higher inflation averaging 3.1% annually between 2020 and 2024 compared to the overall CPI inflation of 1.8%.

CPI and annual inflation on food at home

GRAPHICS: THE STAR

Khazanah Research Institute’s research associate Dr Teoh Ai Ni said the total amount spent on food consumed at home would vary depending on how frequently individuals spend eating at home.

She said Malaysians also spend a larger portion of their monthly spending for food on food at home compared to Singaporeans.

“Data from the Household Expenditure Survey 2022 shows that Malaysian households spent about 48% of their total monthly food expenditure on food away from home, with 52% spent on food at home.

“In comparison, Singaporean households spent 68% of their food expenditure on food away from home.”

“This is why the consumer expenditures spent on food at home for Singapore is lower than that of Malaysia, and it does not imply that food in Malaysia is more expensive,” she said.

She noted that the use of US dollar in USDA’s data as the unit for comparison does not take into account the variations in the current strength or cost of living, nor does it equal purchasing power.

Fellow research associate at KRI, Nik Syafiah Anis said Malaysia is also one of the more food import-dependent nations in Asean, which means its food system is vulnerable to global supply chain disruptions and external price shocks.

She said other Asean countries such as Thailand and Vietnam have transitioned into major agricultural powerhouses, with Vietnam’s food exports surging more than 15-fold between 1995 and 2018, driven by rice, seafood, and coffee.

She in comparison, Malaysia’s food import bill reached RM75.6 billion in 2022 and it remains a net importer of essential food items, particularly animal or vegetable fats and oils, cereals, and dairy products.

“One key dimension of this dependency is the country’s reliance on imported animal feed – particularly corn and soymeal, which are key inputs in poultry, livestock, and aquaculture production.

“For example, Malaysia imports around 95% of its corn needs, largely from Argentina, Brazil, and India. This includes corn for feed and food, seed, and industrial (FSI) use,” she said.

She said over-reliance on imported feed has a trickle-down effect on domestic food prices.

She added that with global disruptions such as geopolitical tensions or poor harvest due to climate change, feed prices can spike, leading to higher prices for chicken, eggs, fish and meat at the consumer level.

Meanwhile, Teoh said the share of income spent on food depends on wages and food expenditure.

Malaysians’ portion of food spending is comparatively lower than most other countries in the region.

“The differences are attributable to a combination of factors, including income level, food prices and food consumption patterns.

She said that as income rises, the share spent on basic necessities like food would likely decrease while the share of spending on discretionary items like entertainment and recreation would likely to rise.