June 19, 2024

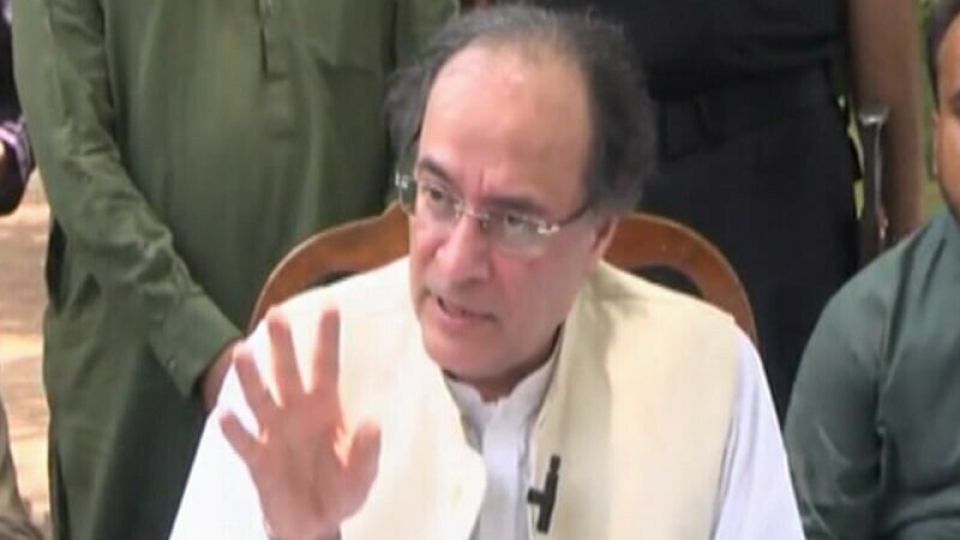

ISLAMABAD – Finance Minister Muhammad Aurangzeb on Tuesday assured that other sectors would be brought into the tax net, while also highlighting the need to reduce tax exemptions.

His remarks come days after the government presented the federal budget for the upcoming fiscal year (FY2024-25) with a total outlay of Rs18.9 trillion, which analysts said was broadly “in line with International Monetary Fund (IMF) guidelines”.

Pakistan’s budget for the upcoming year aims for a modest 3.6 per cent gross domestic product (GDP) growth, and sets an ambitious Rs13tr tax collection target, raising taxes on salaried classes and removing tax exemptions for the rest.

Aurangzeb, during the budget presentation, had said that the goal was to widen the tax base to avoid burdening existing taxpayers.

Speaking at a press conference in Kamalia today, Aurangzeb said that the current tax-to-GDP ratio of 9.5 per cent was “not sustainable”.

“Schools, universities and hospitals can function with charity and philanthropy. Countries can only function with taxes,” he said, adding that the tax-to-GDP-ratio needed to be increased to 13pc.

He said that there were several ways to achieve this, including imposing direct taxation where previously there was none and the need to reduce tax exemptions.

“We have tax exemptions, or expenditures, of Rs3.9tr. We call them expenditures but they are exemptions and we need to reduce those exemptions,” he said, adding that the government had “ring-fenced some areas”, including health and agriculture.

The finance minister assured that the government was “bringing other sectors into the tax net”. He noted that approximately 32,000 retailers had been registered, adding that they would be taxed from July onward.

“There cannot be a segment which we do not bring under direct taxes,” he stressed.

“Because if we do not bring them in, then the conversation of what is happening with the salaried class and manufacturing [sector] will keep continuing. So there are other sectors that are going to be brought into the net,” he said.

At the same time, Aurangzeb also acknowledged the government’s inability to enforce existing laws. “This is not your fault, or our fault — our tax authority has to step up,” he asserted.

He said that implementation of the track and trace system had been “lax”, because of which revenue was not collected.

However, he noted that the government was aware of these shortcomings and consulting firm McKinsey had been working with the Federal Board of Revenue (FBR) for the past four weeks.

“The purpose of that is end-to-end digitalisation […] and with automation there will be less human interaction. I’m not saying it will end human interaction, only that it will lessen it […] there will be transparency and less corruption,” he said.

The minister said that people were hesitant of entering into the tax net due to “harassment and frivolous notices”, adding he was “also on the receiving end” since he had been in the private sector for six years.

The minister also announced that outsourcing of airports was being completed, with the Karachi airport set to be handed over to the private sector by July or August this year.

The minister said the federal government would shut down ministries or departments that had been devolved to the provinces, adding that the move was expected to reduce expenditure and improve efficiency.

He said that Prime Minister Shehbaz Sharif had already announced the closure of Pakistan Public Works Department, a move that would help reduce the financial burden on the government.

He further said that the government would privatise state-owned enterprises (SOEs). He cited the example of Pakistan International Airlines (PIA), saying it had liabilities of Rs622 billion that had been transferred to the government.

“The privatisation of SOEs will help reduce the financial burden on the government and improve efficiency,” he said.