June 1, 2022

MANILA – MANILA, Philippines—Borrow more. Spend less. Tax the poor or the rich?

The think tank Ibon Foundation said these are the fiscal choices that the government has to generate income and pay off debts, but the outgoing administration of Rodrigo Duterte had chosen to keep its hands off the last option—tax billionaires.

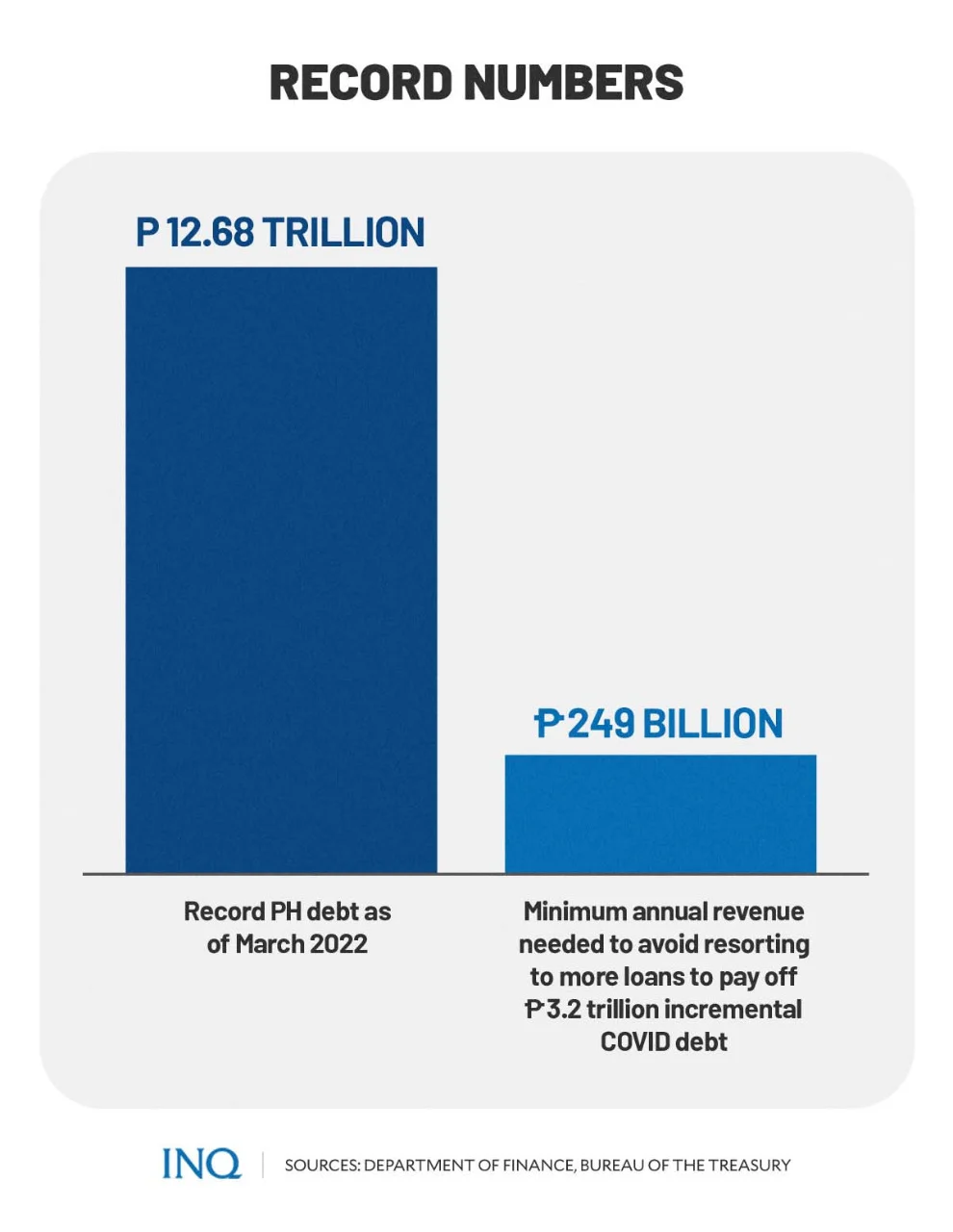

Last week, the Department of Finance (DOF) proposed new and higher taxes to service the Philippines’ record debt and bring down the level of these obligations that reached an all-time high of P12.68 trillion in March. It was expected to breach P13 trillion by the time Duterte is gone.

GRAPHIC: Ed Lustan

Finance Secretary Carlos Dominguez said the proposed Fiscal Consolidation and Resource Mobilization Plan, which will be presented to the next administration, is a “doable” set of measures that are “fair, efficient and corrective”.

The DOF explained that if the COVID-19 crisis did not happen, the outstanding debt would only reach a record of P9.9 trillion by yearend, however, because of massive borrowings, which the government said was for crisis response, obligations are now expected to hit an all-time high of P13.1 trillion.

GRAPHIC: Ed Lustan

To pay off debts, the DOF said the government can generate P349.3 billion in incremental income every year if President-elect Ferdinand Marcos Jr. will implement these proposed tax reform packages from 2023 to 2025:

The first package, which is expected to be implemented in 2023, includes the proposed deferment of cuts in personal income tax rates for 2023 to 2025 under the Tax Reform for Acceleration and Inclusion (TRAIN) Act.

The DOF likewise recommended the repeal of exemptions from paying 12 percent value-added tax (VAT), reimposition of the 60-month amortization period of input VAT on capital goods.

It also includes the proposed imposition of VAT on digital service providers, like online advertisement services, digital services, and supply of other electronic and online services; motor vehicle users’ charge (MVUC) reform by initiating a single and unitary rate based on the gross weight of all vehicles.

The DOF likewise proposed levying excise on pickups and motorcycles; establishment of a single and rationalized fiscal regime applicable to all mining agreements; imposition of taxes and charges on gaming; excise on single-use plastics and luxury goods and taxes on social media influencers.

The second package, which is expected to be implemented in 2024, recommended reforms on health taxes, like alco-pops, cigarettes, e-cigarettes, sweetened beverages, and non-nutritious food.

The DOF likewise proposed the indexation of oil excise and the excise reform on coal and the repeal of Presidential Decree No. 972, tax on cryptocurrencies and strengthening the Bureau of Internal Revenue’s capacity to perform transfer pricing audit to address emerging audit requirements.

The third package, which is expected to be implemented in 2025, is made up solely of a tax on carbon emissions.

These, as the Bureau of Treasury said that to prevent having to use borrowings to pay the P3.2 trillion in incremental debt, “we need to raise P249 billion every year in incremental revenues”.

The DOF said this indicates that the government has to generate more income, improve tax administration and cut unnecessary spending with fiscal reforms that are expected to generate P349.3 billion every year.

- First package: P247.8 billion every year

- Second package: 126.8 billion every year

- Third package: still to be determined

‘Let the rich pay’

For economist and Albay Rep. Joey Salceda, P326 billion in new revenues are needed every year to service COVID-19 debts—P144 billion for principal payments and P181 billion for interest payments.

GRAPHIC: Ed Lustan

Last April, the DOF even said that it will take 40 years—two generations—to pay off the P1.31 trillion debt that the government incurred solely for COVID-19 response. However, Ibon Foundation said only a fraction of this record borrowing really went for the health crisis:

- 23 percent was for clear COVID-19 programs

- 51 percent was ambiguous

- 26 percent was not really for COVID-19

The proposed new tax reform, Ibon Foundation executive director Sonny Africa said, will lower deficit and moderate borrowing so as not to make obligations swell, stressing that the income earned will go to the national treasury and be spent on government programs—education, health care and other critical socioeconomic programs.

GRAPHIC: Ed Lustan

However, he said that the problem with the proposals is not the income being generated but where they are being generated from, saying that an estimated three-fourths of the projected take will be from indirect consumption tax.

Africa told INQUIRER.net that this kind of tax is regressive and will only “disproportionately burden the poor and ordinary Filipino households with higher prices of goods and services”.

“If the government really wants to raise revenues, it should support the billionaire wealth tax bill that was filed by Makabayan representatives last year,” he said.

Africa stressed that 2,919 Filipino billionaires are worth P8.1 trillion, which is already 16 percent of the wealth of the Philippines. “A tiny wealth tax on this will contribute P467.1 billion to government revenue,” he said.

“Will Marcos Jr. and his continuity economic team be brave and original enough to choose taxing billionaires”? Africa asked.

Why not the poor?

Last year, he said Duterte’s tax reform programs—Train Act and the Corporate Recovery and Tax Incentives for Enterprises (Create) Act—mirrors “reliance on indirect consumption taxes which burden the poor while reducing taxes for rich and big corporations.”

This is what the new proposals look like, saying that “this is bad tax practice in general, especially now with millions of families suffering from post-lockdown joblessness, collapsed incomes and savings, and small business closures”.

In its latest survey on self-rated poverty, the Social Weather Stations said 10.9 million Filipino families considered themselves “poor” in the first three months of 2022, slightly higher than the 10.7 million in December 2021.

Last March, while the Philippine Statistics Authority said that joblessness has improved—2.87 million, down from the 3.13 million in February—Ibon Foundation said the economy is still not creating enough decent work.

This as the minimum wage in the Philippines is not yet keeping up with the “living wage” that a family of five, especially in Metro Manila, needs to live decently now that inflation rose by 4.9 percent in April.

Africa said that the number of households without savings likewise rose by some three million between 2016 and 2021.

For Rep. France Castro (ACT Teachers), “the proposed deferment of the scheduled income tax reductions and the repeal of certain tax exemptions will be increasingly punishing to the poor and middle class who have been greatly hit by the economic crisis brought by the pandemic.”

Africa explained that while DOF has not been very specific with the proposals it released, they are already concerned with the possibility that some of the VAT exemptions that will be lifted are these:

- Goods and services bought by seniors and persons with disabilities

- Home rentals below P15,000

- Regularly published newspapers, magazines and books

- Cooperative sales (non-agricultural/electric/credit)

- Personal effects of Filipinos returning from overseas

- Individual services in employer-employee relationship

- Imports for commercial sales/manufacturing of persons settling in PH

- Real property sales

- Flights by international carriers

“It’d be helpful for the DOF to release its specific proposals and revenue projections,” he said.