December 15, 2022

SINGAPORE – Singapore’s growth prospects have become gloomier and the economy is bracing itself for a sharp downturn in 2023.

Private-sector economists cut their 2023 growth forecast for export-driven Singapore by a full percentage point. They cited a global economic slowdown as the key downside risk.

The economists also raised their forecast for inflation both this year and next, as price pressures continued to pose a concern.

Economic growth for 2023 was projected at 1.8 per cent in the quarterly survey of professional forecasters released by the Monetary Authority of Singapore (MAS) on Wednesday.

The forecast is down from the 2.8 per cent gross domestic product (GDP) growth predicted in the September survey.

But the 21 economists and analysts who responded to the MAS survey sent out in November upgraded the 2022 GDP growth projection to 3.6 per cent, from the 3.5 per cent predicted in the previous survey published in September.

The Ministry of Trade and Industry in November said it expects GDP growth of around 3.5 per cent in 2022 and between 0.5 per cent and 2.5 per cent in 2023.

This came amid recession fears in Europe and the United States and prospects of continued sluggish growth in China – all major trading partners of Singapore.

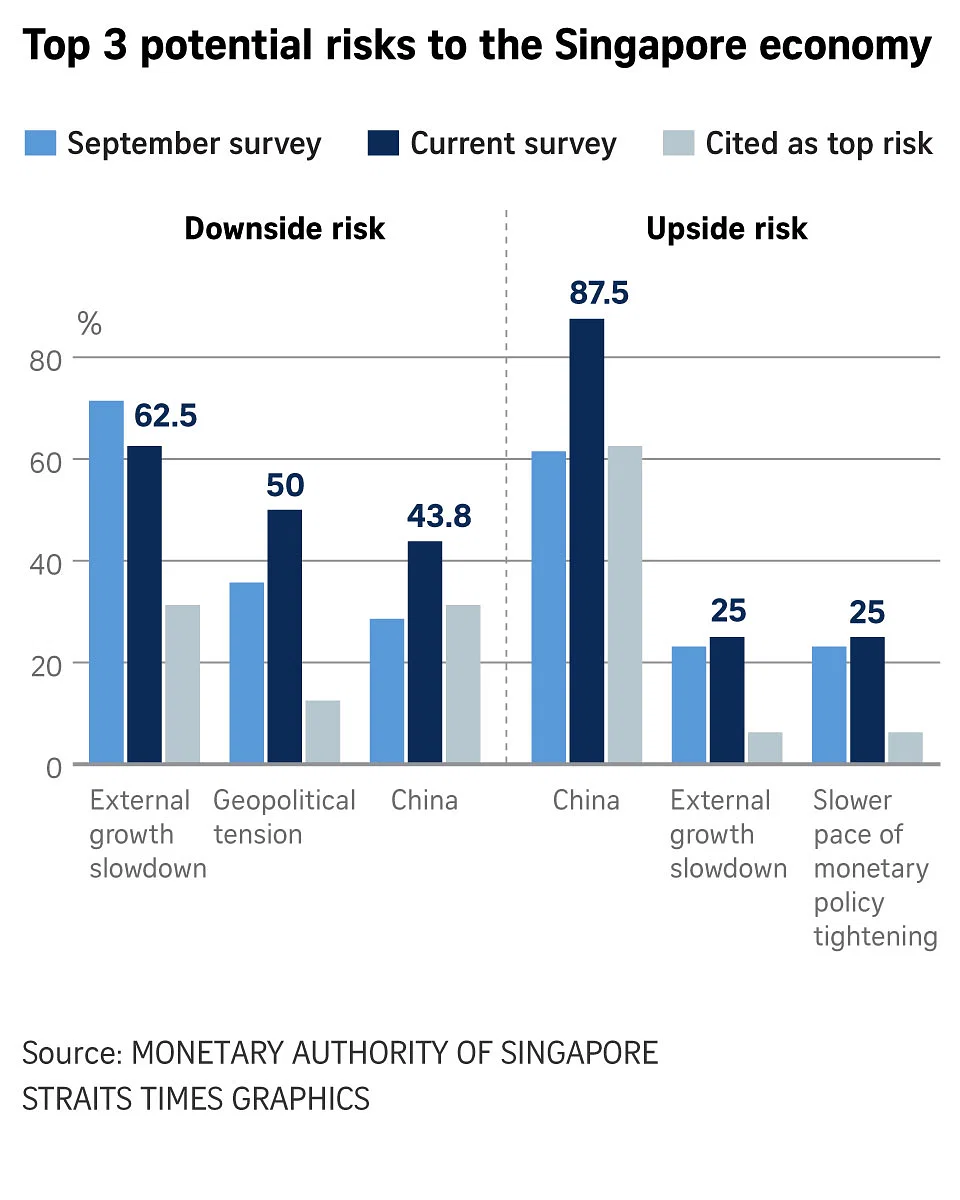

Some 62.5 per cent of the survey respondents flagged the global slowdown as a key risk that could dampen Singapore’s growth outlook next year.

It was ranked as the top concern by 31.3 per cent of respondents.

Other concerns clouding the growth picture include an escalation in geopolitical tensions and a possible spillover from China brought about by coronavirus lockdowns and social unrest.

At the same time, more robust growth in China – underpinned by lower interest rates and relaxation of Covid-19 curbs – was the most frequently cited factor that could boost Singapore’s growth above the forecast.

While the survey was carried out before China announced an effective end to its controversial zero-Covid policy earlier this month, most analysts are still not sure how strong a rebound will be and whether it would be enough to offset the expected recession in the US and Europe.

Ms Sonal Varma, the Singapore-based chief economist for India and Asia ex-Japan for Nomura International, said recessions in the West would deepen Asia’s export downturn in the new year.

China’s share of Asia ex-Japan’s exports is high, at about 19.5 per cent of total exports, but lower than the combined share of the US and Europe, estimated at 25 per cent, she said.

Also, there is a timing mismatch.

A durable China recovery is likely only in the second half of 2023, while the recessions in the US and Europe are imminent, said Ms Varma.

“As the downturn in the US and Europe gathers steam – and before China’s growth engine truly revs up – we see a potential export demand vacuum emerging in the first quarter of 2023 and parts of the second quarter, which could result in an even sharper export growth slump,” she said.

The economy started 2022 on a high note on the back of a solid showing in the previous year, rising vaccination and further easing of Covid-19 measures. But inflationary pressures worldwide that led to tighter monetary policies as well as the Ukraine war have dampened global economic growth and lowered demand for Singapore exports.

DBS Bank senior economist Irvin Seah said the export-driven manufacturing sector, which drove growth in 2021, has now become a drag.

“Growth momentum in the sector is waning due to China’s slowdown, a decline in global electronics demand, and tighter liquidity conditions,” he said.

China’s unwinding of Covid-19 measures in 2023 will be pivotal, but there is a high degree of uncertainty over how it will pan out, he added.