April 20, 2023

SEOUL – Samsung Electronics has regained the top spot in the global smartphone market in the first quarter of this year, slightly outpacing its archrival Apple, the No. 1 in the previous quarter, a report showed Wednesday.

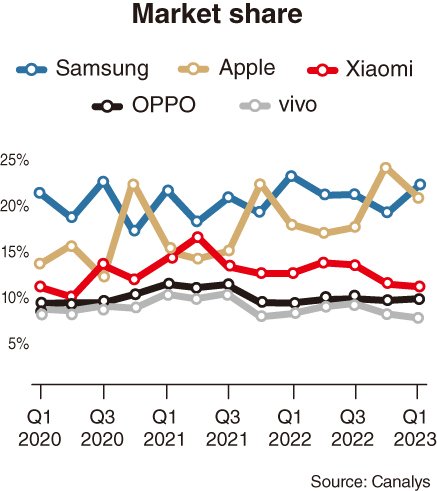

In the January-March period, Samsung held a market share of 22 percent, followed by Apple with 21 percent, according to the report released by market tracker Canalys. The South Korean tech giant was the “only leading vendor” to achieve a quarterly jump during the first three months of the year, the report said.

Samsung lost the top spot to Apple in the October-December period last year following the launch of the iPhone 14 series. At the time, Apple made up 25 percent of global smartphone sales, while Samsung took 18 percent.

Starting in February this year, Samsung could elevate sales as it rolled out the latest flagship Galaxy S23 series in some 130 countries. Compared to the previous S22 series, its flagship smartphone sales jumped about 70 percent on-year in some regions, beating earlier expectations, the company said. In Korea alone, the phone sales exceeded the 1 million mark earlier this month.

“The powerful performance of the Galaxy S23 Ultra model and its most innovative feature, the camera with a 200-megapixel sensor, succeeded in capturing the hearts of consumers,” an industry source told The Korea Herald under the condition of anonymity.

During the same period, however, the market share gap between Samsung and Apple was just 1 percentage point, down from 6 percentage points a year ago, which could endanger Samsung’s dominant market position.

In the meantime, Chinese smartphone maker Xiaomi remained the third-largest smartphone vendor over the cited period with an 11 percent market share.

Two other Chinese rivals, Oppo and Vivo, made up 10 percent and 8 percent, respectively, as they secured a firmer footing in the Asia-Pacific region and their home market.

Canalys analyzed that the overall global smartphone market experienced a fifth consecutive quarterly loss, falling by 12 percent on-year in the first quarter, and the market is yet to recover despite limited improvements in major unfavorable macro factors.

“It is still too early to predict the recovery of overall consumer demand. However, the sell-in volume of the global smartphone market is expected to improve due to the reduction in inventories in the next few quarters,” Canalys analyst Toby Zhu noted.

While some smartphone vendors are becoming more active in production planning and ordering components, smartphone sales are slowing as companies increasingly focus on innovation, efficiency and quality over quantity as their strategic priority, he added.