July 25, 2023

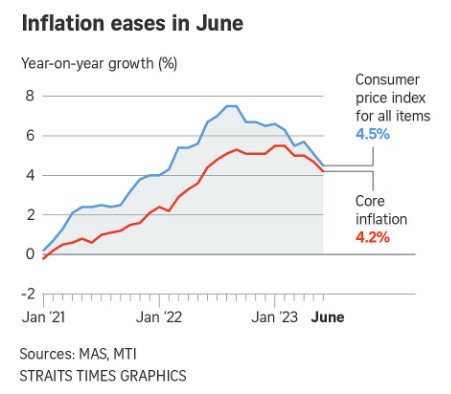

SINGAPORE – Inflation in Singapore cooled for a second straight month as prices of food, services and private transport rose at a slower pace, prompting the Government to lower its forecast for overall inflation for 2023.

If the trend lasts, private economists, who say the moderation is expected, believe that core inflation could go down to 3 per cent or lower for the full year.

Core inflation, which excludes private transport and accommodation costs in order to better reflect the expenses of Singapore households, dropped to 4.2 per cent year on year in June, from 4.7 per cent the previous month.

The June figure matches that from a Reuters poll of economists.

This brings core inflation to its lowest since mid-2022.

Headline inflation, or the overall consumer price index, also eased to 4.5 per cent, from 5.1 per cent in May.

The Reuters survey had pegged headline inflation to be 4.55 per cent in June.

The decline came on the back of a fall in private transport inflation led by smaller hikes in car prices and a steeper fall in petrol costs.

The Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) in its report on Monday lowered their forecast for overall inflation for the year to between 4.5 per cent and 5.5 per cent, from the 5.5 per cent to 6.5 per cent previously.

Core inflation estimates remain the same, at between 3.5 per cent and 4.5 per cent.

MAS and MTI said core inflation is expected to moderate further in the second half of 2023, as imported costs fall from year-ago levels and the current tightness in the domestic labour market eases.

“There is a good probability of core inflation subsiding below the 3 per cent handle by the fourth quarter,” OCBC chief economist Selena Ling said, adding that the easing of inflation is “a positive affirmation of the MAS decision to pause tightening of monetary policy back in April”.

She noted that core inflation is taking a bit longer to return to the 2.5 per cent to 3 per cent year-on-year handle due to a still tight labour market, resilient domestic demand and the return of more overseas visitors, among other factors.

Oxford Economics senior economist Alex Holmes said the month-on-month figures, which show how much momentum there still is in prices, are key at this stage.

“While headline consumer price index was up 0.5 per cent month on month in June, that was mainly due to transport prices, which are excluded in the core measure.

“Core inflation rose only 0.2 per cent month on month, which is the equivalent of about 2 per cent at an annualised rate – close to normal. If this trend continues, we can expect core inflation of 3 per cent by the end of the year,” he noted.

DBS economist Chua Han Teng said he expects core inflation to ease further in the second half of 2023, and that “it looks on track to meet the MAS’ end-2023 forecast range of 2.5 per cent to 3 per cent”.

“Factors supporting our view include a higher base comparison a year ago, a reduction in imported prices, gradual easing in domestic labour cost pressures and the dampening impact from monetary policy,” he said.

Private transport inflation clocked the biggest fall to 5.8 per cent in June, down from 7.2 per cent in May.

Food inflation eased to 5.9 per cent from 6.8 per cent in May as the prices of non-cooked food and prepared meals rose at a slower pace.

Services inflation edged down to 3.6 per cent from 3.9 per cent the previous month, reflecting a slower pace of increase in holiday expenses and airfares.

Accommodation inflation dipped to 4.5 per cent as housing rents rose more slowly.

Inflation for retail and other goods declined to 2.7 per cent as the prices of personal care, medicine and health products recorded smaller hikes.

Electricity and gas inflation eased to 3.1 per cent on the back of a smaller increase in electricity costs.