February 15, 2023

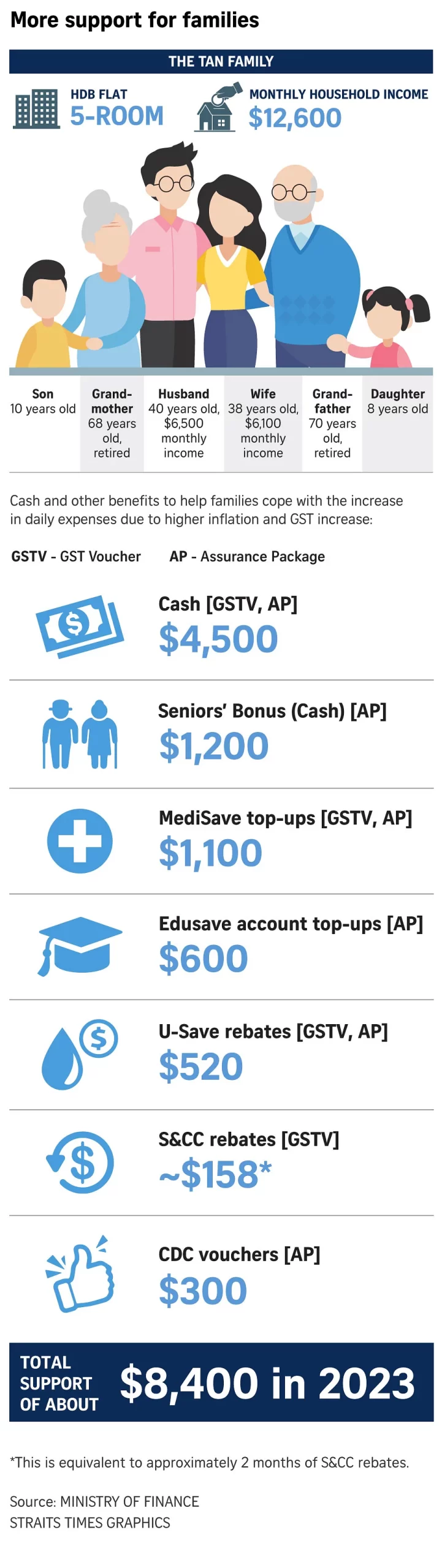

SINGAPORE – A range of payouts, top-ups and rebates was announced in Budget 2023 to help Singaporeans deal with higher inflation and the increase in GST, which was raised from 7 per cent to 8 per cent in January 2023.

Here are what Singaporeans can expect to receive, on top of what was announced previously.

For adult individuals

1. Enhanced GSTV – Cash (new)

What it is: A payout to defray GST expenses

How much: Singaporeans aged 21 or older earning up to $34,000 and living in homes with an annual value of up to $13,000 will get $700 this year – an increase of $200 from last year’s Budget. They will receive $850 in 2024. Those who live in homes with an annual value of between $13,000 and $21,000 will get $350 this year – an increase of $100 from last year’s Budget. They will get $450 in 2024.

When it will be disbursed: In August each year

2. Assurance Package (AP) – Cash (new)

What it is: A payout to offset the increase in GST

How much: Every Singaporean aged 21 years or older who earns no more than $100,000 a year and does not own more than one property will get between $300 and $650 more over the next four years. This brings the total payout to between $1,350 and $2,250 per person.

When it will be disbursed: December each year, until 2026

3. Assurance Package – Cost-of-Living Special Payment (new)

What it is: A one-off payout to address cost-of-living needs

How much: Between $200 and $400 for Singaporeans who are 21 years old or older in 2023, earning $100,000 or less a year and do not own more than one property.

When it will be disbursed: June 2023

For Singaporean households

1. Assurance Package – CDC vouchers (new)

What it is: Vouchers to offset household expenses

How much: All households will receive $300 in Community Development Council (CDC) vouchers in 2024, $100 more than previously announced. In January this year, every Singaporean household received $300 worth of CDC Vouchers. These can be used at heartland merchants and participating supermarkets.

When it will be disbursed: January 2024

2. Cost-of-Living U-Save Special Payment (new)

What it is: Rebates to offset utility bills

How much: Those living in HDB flats and whose household members do not own more than one property will receive double the amount of U-Save rebates for the rest of 2023. These households can get between $440 and $760 in rebates this year.

When it will be disbursed: April, July and October 2023

3. Assurance Package – U-Save

What it is: Additional rebates that will be credited with the usual GSTV – U-Save rebates from 2023 to 2026

How much: Depending on the household’s flat type, Singaporeans would have received between $55 and $95, with the first payment in January.

When it will be disbursed: January 2023, January and July 2024 and 2025, and January 2026

4. GSTV – Service and Conservancy Charges rebate

What it is: A rebate to offset service and conservancy charges for those living in HDB flats

How much: Depending on flat type, households will receive between 1.5 and 3.5 months of rebates.

When it will be disbursed: January, April, July and October 2023

For children and youth

PHOTO: ST FILE

1. Child Development Account top-up (new)

What it is: A one-off payment for children up to six years old

How much: $400

When it will be disbursed: September 2023

2. Edusave and Post-Secondary Education Account top-up (new)

What it is: A one-off payment for children and youth between seven and 20 years old

How much: $300

When it will be paid: May 2023

3. Assurance Package – MediSave

What it is: A top-up to MediSave accounts for those up to 20 years old

How much: $150

When it will be disbursed: February 2023, 2024 and 2025

For seniors

ST PHOTO: LIM YAOHUI

1. Assurance Package – 2023 Cost-of-Living Seniors’ Bonus (new)

What it is: A one-off payout to defray cost-of-living expenses for Singaporeans aged 55 or older who earn less than $34,000 a year and do not own more than one property

How much: Between $200 and $300, depending on age and home value which should not exceed $21,000

When it will be disbursed: June 2023

2. Assurance Package – Seniors’ Bonus

What it is: Previously known as GSTV – Cash (Seniors’ Bonus), to be paid to eligible seniors aged 55 or older who have an annual income of $34,000 or less and do not own more than one property

How much: Between $200 and $300 each year

When it will be disbursed: February 2023, 2024 and 2025

3. Assurance Package – MediSave

What it is: An annual top-up to MediSave accounts for those aged 55 or older

How much: $150 each year

When it will be disbursed: February 2023, 2024 and 2025

4. GSTV – MediSave

What it is: An annual top-up to help eligible senior Singaporeans aged 65 or older who have a residential address tied to a property where the annual value is $21,000 or less and who do not own more than one property

How much: Between $150 and $450

When it will be disbursed: August each year

Read next – Budget 2023: What you need to know – from more cash payouts to higher property and car taxes