July 26, 2022

SINGAPORE – Prices continued to climb in June with inflation touching its highest levels since 2008.

With supply chains disrupted and the war in Ukraine still raging, prices are expected to continue rising over the next several months.

Singapore has been trying to rein them in by strengthening its currency – making its imports cheaper – but as June’s numbers show, this remains an uphill task.

Both measures that Singapore uses to gauge price levels climbed sharply last month.

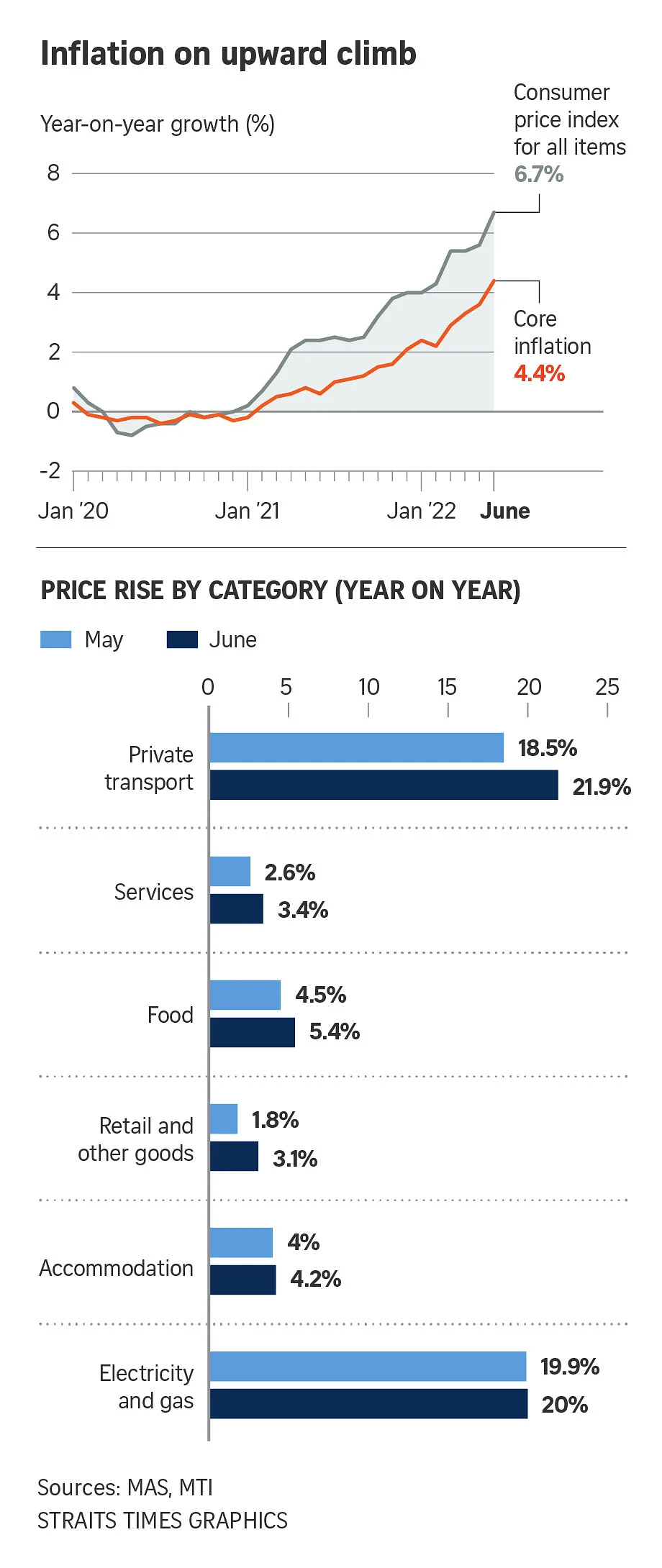

Core inflation, which excludes costs of private transport and accommodation and better reflects the average bills of Singaporeans, went up to 4.4 per cent.

Driven by higher prices of food, retail and utilities, it touched its highest level since November 2008.

Overall inflation, or headline consumer price index (CPI), for June also scaled its highest peak since September 2008, hitting 6.7 per cent year on year. It was fuelled by rising costs of private transport and accommodation.

The authorities have pushed up their projections for the year. They expect headline inflation to come in at between 5 per cent and 6 per cent and core inflation between 3 per cent and 4 per cent.

Food inflation in June hit 5.4 per cent from 4.5 per cent in May.

There was also higher broad-based inflation across services, retail, electricity and gas, accommodation and private transport.

The Monetary Authority of Singapore and the Ministry of Trade and Industry

expect core inflation to peak in the third quarter before easing towards the end of the year.

Car and accommodation cost increases are also likely to stay firm for the rest of the year, while Singapore’s labour market is projected to remain tight and wage growth strong.

“Amid firm consumer spending, businesses are likely to pass on the increases in the prices of fuel, utilities and other imported inputs, as well as labour costs, to consumer prices,” they added.

While some commodity price rises have levelled off, the authorities still expect the pressure on Singapore’s import prices to remain.

CIMB economist Song Seng Wun said he expects core and headline inflation to rise at a slower pace in the fourth quarter.

“The cumulative effect of the MAS monetary policy tightening moves so far should ensure 2022 inflation stays within the latest forecast,” he said.

OCBC Bank’s chief economist Selena Ling said the jump in headline inflation was a surprise and higher than she had forecast. Core inflation did not pick up as fast.

She does not expect Singapore to see any near-term respite and projects headline inflation to peak around September to October, possibly around 7 per cent year on year.

In the first half of the year, inflation rose by 4.2 per cent year on year for the lowest income group, 4.9 per cent for the middle income and 6 per cent for the highest income group.

Ms Ling said the impact of inflation on the lower-income households “is still very substantial” despite targeted subsidies, as their wage adjustments “likely lagged behind during this period”.

Mr Song said food inflation rose 3.7 per cent year on year in the first half of 2022, compared with 1.2 per cent year on year in the same period a year ago.

“Food accounts for a larger proportion of the basket of goods and services for the lower 20 per cent income group. But the middle income group, the 60 per cent, is hit with both food as well as services inflation, such as taking overseas trips,” he said.

Households will need to work out the impact of higher costs of living, said Mr Song.