August 1, 2022

PHNOM PENH – Macroeconomic measures are being implemented to stem a 13-year high inflation rate and its cascading effects on the economy, but more efforts are needed amid a looming global recession

Another 75 basis points has been instituted by the US Federal Reserve, bringing the interest rate range to 2.5 per cent in four months since the first increase in March to quell inflation in the US.

Coupled by the Russia-Ukraine war, these have precipitated moves by central banks and governments to bring high inflationary pressures under control.

The upsurge is worrying, but the factors causing it cannot be controlled by central banks, European Central Bank (ECB) president Christine Lagarde remarked recently. Instead, they can only ensure that it “does not become persistent”.

On that pretext, the ECB reversed years of negative interests to raise the rates by 0.5 percentage points in the Eurozone, in line with its commitment to bring inflation back to two per cent in the medium term.

Against this backdrop, the International Monetary Fund has twice revised its global gross domestic product (GDP) forecast downwards, this time to 3.2 per cent for 2022 from 4.4 per cent earlier this year.

It also recalculated inflation for emerging markets, which is expected to end 2022 on a high of 9.5 per cent, correcting its April’s 8.7 per cent forecast for the year, while foretelling a recession due to runaway inflation.

In Cambodia, headline inflation has surged to 7.2 per cent year-on-year as of March 2022 on the back of stronger US dollar and rising fuel prices, eliciting some anxiety, with measures taken to improve domestic price upswings.

According to National Bank of Cambodia (NBC) data, the 13-year high consumer price index (CPI), a measure of inflation, appeared as a culmination of steady expansion from 3.7 per cent at the end of December 2021.

To be sure, CPI has towered above 35 per cent and collapsed to below one per cent within a span of a year during the 2008/2009 global financial crisis.

In the present day, domestic consumption has improved following the reopening of the economy, the World Bank noted, with imports of goods (excluding gold) expanding at 21.6 per cent year-on-year in the first quarter of 2022.

Source: Cambodia Economic Update (World Bank, June 2022)

In that, petroleum product imports, namely gasoline and diesel products, rose 64.9 per cent and 56.3 per cent, respectively.

Globally, price pressures have rose quickly, spilling over to Cambodia’s dollarised economy, the World Bank stated in its latest economic update.

“Given that Cambodia’s economy is highly dollarised and the riel has been pegged to the dollar, rising inflation in the US leads to rising domestic price pressures, which often results in ‘imported’ inflation,” it wrote.

Last month, Prime Minister Hun Sen rued over the impacts from the war and the pandemic on Cambodia, urging everyone to be “prepared to accept” the circumstances surrounding an economic downturn.

“This is something we must work together to maintain good macroeconomic stability and the purchasing power of the riel, and prevent inflation,” he said, without dismissing the risk of food security if global conditions worsen.

The government has revised down petrol pump prices twice in the last month in a bid to subdue the burgeoning prices of household items amid cash transfer programmes to poor and vulnerable households.

To stabilise the riel, nearly $600 million was sold via auctions by the NBC in 2021, allowing the exchange rate to hover around 4,099 riel per USD. This year, NBC targets exchange rate to average around 4,065 riel, noting that it remained stable.

However, the central bank reportedly said monetary policy would be leveraged to ensure macroeconomic stability and a stable riel to USD exchange rate in the second half of 2022.

Squeezing margins

Going forward, could erratic exchange rates influence interest rates in Cambodia and, to a certain extent, public debt repayment? Looking at a strong greenback, economist Chheng Kimlong commented that there may only be a “small concern” over the negative impact on the riel.

However, a “general anxiety” is in relation to the weaker euro (dipping below the dollar) could result in “transmission effects” kicking in.

As for any influence on interest rates, Kimlong said there may not be “much effect as yet”. “That will be determined by the money supply and the foreign exchange earnings [in Cambodia].”

The anticipation of an impact from the US dollar is “everywhere”, said economist Oudom Cheng, remarking that its “harbinger” is the private sector.

However, he believed that investors have already priced in the possible impact for some time now, so they need not be in a state of “distraught” for now.

Meanwhile, the central bank has been intervening to limit the depreciation of the exchange rate since the inception of the Covid-19 pandemic, he noted.

In terms of an increased interest rate in future, Oudom, who is with NBC, said it is likely that domestic interest rates can “somewhat go up”.

“However, the magnitude is inconspicuous as the determinants of interest rate can include competition, cost structure, profit margin, sources of funding and others,” he added.

When asked about the risk on public debt repayment, Kimlong, vice-president of the Asian Vision Institute (AVI), a Phnom Penh-based think-tank, dismissed them, saying that there might not be much. “Although prolonged and deepened effects may cause an impact.”

Asia Pacific associate economist Eve Barre of credit insurer Compagnie Francaise d’Assurance pour le Commerce Exterieu (Coface), pointed out that almost all of Cambodia’s public debt is denominated in foreign currencies, therefore is subject to exchange rate risk.

As of March 31 this year, 42 per cent of the debt was in US dollar. “In the current case of a strong dollar, [this would] mean higher public debt disruptions for the Cambodian government.”

That said, the NBC’s exchange rate intervention tool has assured price stability.

The recent increase in the value of dollar against a basket of currencies has not been accompanied by a similar clear trend in its value against the Cambodian riel.

This, Barre said, indicated active intervention by the central bank to stabilise the exchange rate. Thus, the effect of a stronger dollar on public debt repayment should be limited.

“High commodity prices in the first half of 2022, especially building materials with infrastructure traditionally representing an important expense item, may have conducted to higher than budgeted public expenses.

“Nevertheless, metal prices have declined for several weeks and Coface does not expect them to rebound strongly to recent high levels anytime soon, suggesting less pressure on public finances in the months ahead,” she said.

Source: Cambodia Economic Update (World Bank, June 2022)

However, ensuing high inflation combined with slower economic growth could squeeze profit margins, said Sisowath Chakara, executive director of newly-registered Rating Agency of Cambodia Plc, the country’s first credit rating firm.

“Those companies that can pass on higher costs to their customers would comparatively fare better than those which cannot,” he told The Post.

Social risk, 7.5% inflation

In its latest report, Fitch Solutions Country Risk and Industry Research warned of “social risks” from rising inflation if economic conditions deteriorate significantly going forward.

Being a net oil importer and one that imports key food items, as pointed out by the World Bank, Cambodia is “exposed to price shocks”.

That being said, a stable exchange and the high degree of US dollarisation in the local economy provide some protection from imported inflation, it said.

The research house, an affiliate of Fitch Ratings Inc, forecast an average inflation of 7.5 per cent in 2022 for Cambodia before easing to 4.5 per cent in 2023.

“Given this expectation for a transient inflation spike, we do not anticipate widespread unrest due to the rising cost of living, particularly as the government has said it will intervene if required to contain excessive increases in the prices of basic food products.

“However, we note higher risks of protests and public discontent with the government if economic conditions deteriorate significantly over the coming quarters,” Fitch Solutions noted.

A study by Moody’s Investors Service Inc in Asia Pacific made similar conclusions. It found that economic slowdown, and job and income losses have disproportionately affected vulnerable countries and communities in the last two years, making them more susceptible to higher commodity prices.

Using its environmental, social and governance risks methodology, Moody’s found that among the economies with the highest social risks in the region, four countries including Cambodia and Laos possessed lower income.

“Because lower-income households tend to spend a large share of their budgets on food, they are significantly affected by higher and more volatile food prices,” it said in the July 19 report.

The credit rating agency also noted that many governments in Asia Pacific have “less fiscal space” post pandemic.

Owing to that, compensating for domestic food price increases would entail fiscal costs for governments or state-owned commodity companies.

The pace of fiscal consolidation in some of these economies is likely to slow as spending pressures persist.

Depending on the design of food subsidies, transfers to vulnerable segments of the population can achieve growth and social objectives.

Back home, the Covid-19 cash transfer programme (CTP) to some 700,000 poor and vulnerable households, or about 17 per cent of the population, has been beneficial, the UN Development Program(UNDP) said this week.

By far, it is the largest component of the government’s support package, where $653 million has been disbursed as of April 2022, the World Bank said, adding that almost 300,000 people have been prevented from falling into poverty in 2020.

Admittedly, the programme has had positive impacts across human development dimensions and socio-economic indicators such as food security, savings, debt repayment and healthcare, UNDP said.

It is expected to carry on for another three months, with plans to extend it to the end of 2022.

The Ministry of Economy and Finance did not respond to questions.

Dwindling savings

Economist Oudom said the cost-push inflation was a result of the spike in oil prices which fed into food prices, hitting core inflation (food and oil prices).

Overall, the elevated inflation can impact economic agents, particularly during economic recovery when income generation is growing only moderately while goods and service become increasingly expensive.

He said protracted periods of higher inflation would reduce investments and consumption, and dampen households’ purchasing power.

It is the poor and vulnerable households, whose income straddle the poverty line, who are suffering the most. While their incomes are spent on basic necessities, these households are also indebted in varying degrees.

The negative impacts on their livelihoods are exacerbated by the concatenated shocks from income loss from the time of the pandemic to the present situation of continuous elevated prices.

“Their savings must have dwindled to a point of exhaustion. We need to know if this factor is affecting their health and children’s education. It is devastating to see this, [knowing that] they might be in anguish,” Oudom said.

What should be displayed now are policy measures that ease inflation and support underprivileged communities and are innocuous to economic growth and financial stability.

As the inflation trend is not due to an “overheating economy”, the NBC economist said, policies should target its genesis while taming the negative impact on poor households.

Even though government savings and reserves have been accumulated to help the poor, budgetary adjustments could be included as additional measures.

Apart from the CTP, introduced in June 2020, and the “laudable” reduction of oil prices, Oudom cited measures that target the root cause of high inflation and are inclusive.

“These include stabilising prices of essential foods and energy [gasoline and utility], easing and expanding low-cost public transportations, extending and prolonging targeted CTP, and expanding accessibility and lowering the cost of public health services,” he said.

Ceiling prices

Although NBC has implemented prudent monetary policies including ensuring liquidity in the market through its financial tools, economists stress that more can be done by the government.

Kimlong of AVI opined that solutions can be targeted on short-term price shocks, particularly “leading commodities” that caused rising inflation and turn to alternative commodities or substitute products.

However, seeing that Cambodia is “import dependent”, he said it might be difficult to address the challenges occurring externally.

The World Bank drew similar analogies, noting how international developments are affecting Cambodia, along with negative terms of trade shock and inflationary pressures which are dampening domestic economic activity.

“Continued sluggishness of international tourism, especially from China slows recovery of the services sector, while risks of weakening external demand are rising,” it said.

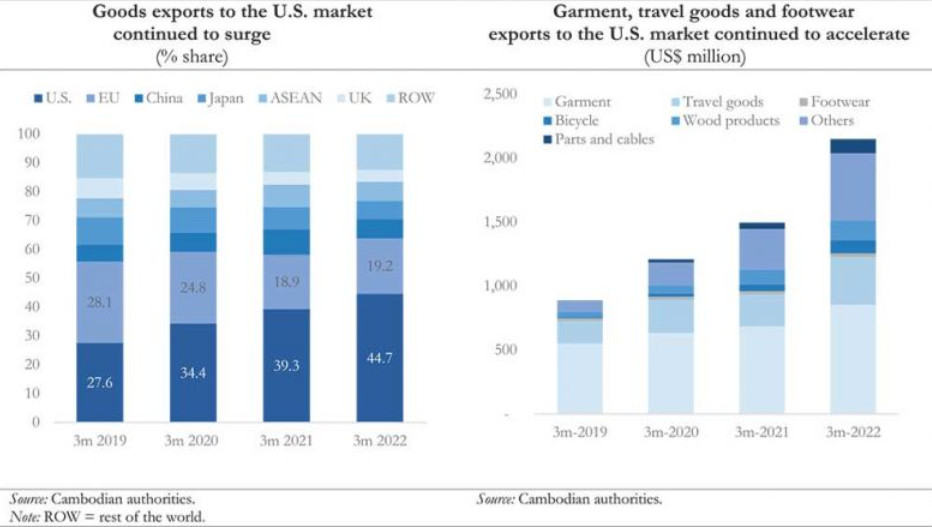

Source: Cambodia Economic Update (World Bank, June 2022)

High inflation is expected to bite into fiscal support measures, given that fiscal deficit remained “elevated but unchanged” at 6.6 per cent of GDP in 2022, as expenditure and revenue growth.

It said expenditure is expected to reach 28 per cent of GDP, driven by expansion of public investment and continued fiscal intervention to mitigate the impacts of the pandemic.

Source: Cambodia Economic Update (World Bank, June 2022)

Economist Barre viewed that fiscal constraints may have stopped the government from increasing subsidies on fuel or introduced subsidies on other basic products where prices are significantly rising, such as food items.

She said if the government is not inclined to use its budget for measures to curb inflation, then it could look at implementing ceiling prices on products which make up a substantial share of the consumption basket. “This could be another solution.”

NBC economist Oudom said cash outlays for vulnerable households are good measures, but they are at the expense of the government.

“Therefore, the disbursement mechanism should be devised in a prudent manner while financing mechanisms are cautiously prepared,” he suggested.

Apart from financing, tax bases should be strengthened and government revenue collected efficiently, he said.

In addition, Cambodia could consider adjusting tax policies to be more inclusive and equitable, similar to policies that are gaining traction in other countries.

The private sector can look at pooling funds for social programmes to relieve the government from having to shoulder the burden of such projects.

“This is also related to sustaining revenue collection while keeping the economy running uninterruptedly as government revenue is very much dependent on the performance of the economy,” Oudom said.

He also mentioned that fiscal tightening should be done so that expenditure to the most pressing sectors are supported.

Efforts should be increased to improve supplies to and within the country, although Cambodia has not experienced a situation where supplies are cut-off or that it is unable to pay for imports due to inadequate foreign exchange, he said.

In this regard, NBC could contribute by continuing to maintain exchange rate stability.

“While the economy remains highly dollarised, this should be the right policy measure as the riel is widely used at the lower-end of the economy by households as well as micro, small and medium enterprises,” he said.

Oudom also recommended the use of macroprudential measures that discourage household leverage in the context that “wealth effects could remain buoyant to the general price level”.

At this juncture, he said the usage of renewable energy should be intensified while the reliance on coal and gas for energy consumption and transportation is gradually reduced from now.

“This would also help to contribute to our national and global climate change mitigation efforts,” he added.