September 9, 2025

DHAKA – Amid global supply chain volatility and higher tariff pressure on China, US buyers are showing fresh interest in Bangladesh’s non-leather footwear and synthetic leather products.

Industry insiders say the shift, though triggered by short-term import duty disruption, could open a long-term window for Bangladeshi exporters aiming to widen their global footprint.

For local non-leather footwear manufacturers, Europe remains the biggest destination, taking almost 90 percent of synthetic shoe exports.

While the US share is still small, companies such as RFL Group, Bling Shoes, Shoeniverse Footwear and Jennys Shoes reported a stable rise in American orders.

The companies say buyers are being drawn by the country’s growing capacity and competitive costs.

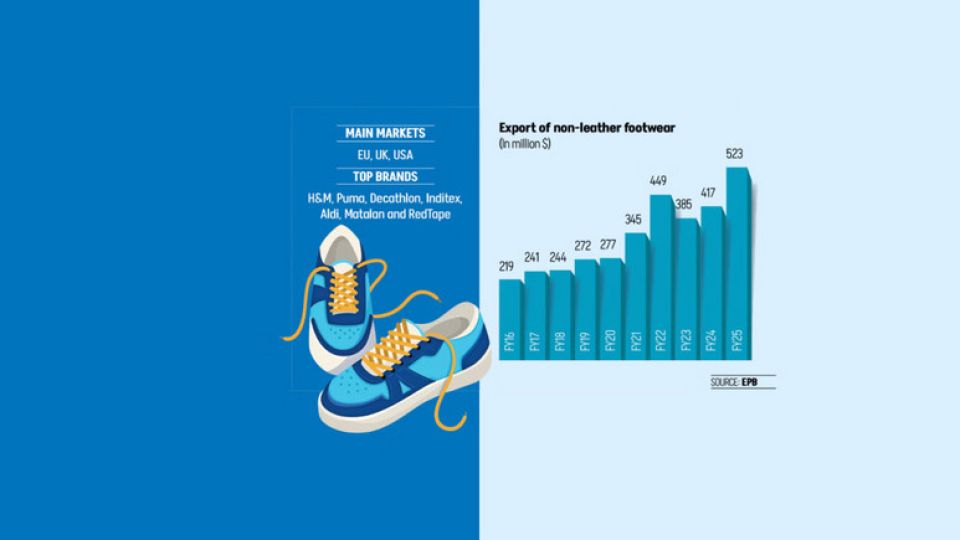

The synthetic leather footwear industry has grown rapidly, more than doubling exports in seven years. This segment earned $523 million in fiscal year (FY) 2024-25, up from $244 million in FY2017-18.

Synthetic shoes are becoming more popular globally than leather for comfort and style. Besides, synthetic materials are less expensive to produce than real leather, making synthetic footwear more accessible to a wider consumer base.

Yet short-term strains amid the US tariff uncertainty on synthetic items are visible. Shipments fell to $42 million in August from $45 million a year earlier, a 7 percent drop.

Domestic manufacturers blame shipment delays and aggressive discounting by Chinese rivals, who diverted excess stock to Europe after losing ground in the US.

“Several consignments to the US were postponed because of uncertainty over reciprocal tariffs. That threw our production schedules off balance,” said Hasanuzzaman Hassan, chairman of Bling Shoes.

He said that it may take up to three months to restore regular flows.

Hassan said, “US buyers are coming back with bulk orders. That shows a long-term shift in sourcing is happening.”

He pointed to American footwear brand Wolverine as an early returner after Washington imposed a total 47 percent tariff on Chinese footwear.

For Shoeniverse Footwear, which has manufacturing units in Tongi and Bhaluka, the European market still dominates.

“About 90 percent of our exports go to Europe. But once Chinese manufacturers lost US orders, they flooded Europe with cheaper products. Some of our regular buyers switched back to them,” said Shoeniverse Managing Director Riad Mahmud.

He said the price war has unsettled exports to Europe, contributing to around 8 percent fall in August.

Even so, Mahmud remains optimistic about the outlook.

“The market is settling. We are adding capacity, and with new factories we expect exports to grow at least 6 percent a month, provided there are no fresh shocks,” he said.

He added that small but steady US orders are already coming in, suggesting sourcing patterns are gradually shifting.

Nasir Khan, chairman and managing director of Jennys Shoes, believes the new US tariffs have opened the door for Bangladesh.

“American brands are exploring new sourcing hubs, and Bangladesh is firmly on their radar,” he said.

Khan said that monthly figures do not always capture the industry’s real performance, as orders are seasonal.

“We are processing winter shipments now, and bulk consignments to the US are already underway,” he said.

Jennys Shoes exports mainly to Japan and Europe, but in the US market it specialises in non-leather sports shoes, with Skechers and Steve Madden among its buyers.

RN Paul, managing director of RFL Group, said their synthetic leather division is receiving US demand for the first time, in both apparel and footwear. “The interest is not entirely new, but the consistency and scale are on a different level,” he said.

RFL began producing synthetic leather with a water-based polyurethane process in 2021. The eco-friendly method has proved attractive to international brands on both compliance and sustainability grounds.

“We are in discussions with H&M and Zara. Our integrated production system gives us an edge,” Paul said.

To meet rising demand, RFL has joined hands with a Chinese firm to expand capacity. “That helps us fill the gap left by China’s reduced exports to the US,” he added.

The company has also extended synthetic leather use beyond footwear to jackets, handbags, wallets and other items previously dependent on imports. “We now make them locally, which adds more value at home,” Paul said.

Despite August’s setback, exporters remain convinced Bangladesh is on the brink of a new growth phase in non-leather footwear and synthetic leather.

“There are short-term bumps, but the long-term opportunity is real and getting bigger,” said Mahmud of Shoeniverse.