February 3, 2023

SEOUL – Market expectation of a Bank of Korea rate freeze is growing, after the US Federal Reserve slowed its pace of interest rate increases for the second straight meeting on Wednesday.

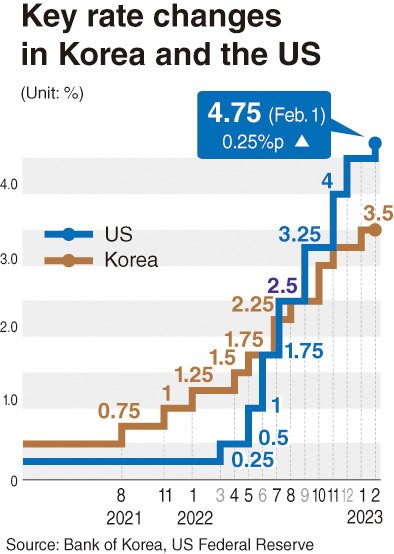

The US base interest rate climbed to 4.5-4.75 percent per annum as the Fed raised the key rate by 0.25 percentage point from the previous 4.25-4.5 percent at the Federal Open Market Committee meeting on Wednesday.

The hike was in line with market expectations that projected the Fed would raise rates more slowly, after an aggressive monetary tightening cycle which began in June last year to tame high inflation.

The Fed’s slowdown signaled a green light for the local currency exchange. The Korean currency strengthened up to 1,216.6 won as of closing time on Thursday. The currency opened at 1,220 won, the lowest in 10 months since 1,219.5 won on April 7, following the FOMC’s decision.

While the Fed’s hint sparked a stock market rally across the world, South Korea’s benchmark Kospi closed at 2,468.88, 19.08 points higher than that of Wednesday’s closing price. The secondary Kosdaq market closed at 764.62, up 13.66 points from the previous day.

More concerns for BOK

The Fed’s hint on easing up the pace of interest hikes has relieved some pressure on the Bank of Korea, compared to last year when the US central bank hiked interest rates by 0.75 percentage point for four times in a row.

Still, concerns over the BOK’s next rate decision remain because of the widening gap between Korea’s key rate and the US’.

With the BOK’s base rate standing at 3.5 percent, the gap between the base rate of Korea and the US goes up to 1.25 percentage points, following Wednesday’s increase.

The gap is at its widest since October 2000 when the figure stood at 1.5 percentage points.

The Korean central bank could likely be pressured to raise the rate by at least 25 basis points to narrow the gap over concerns of a possible foreign capital outflow and fall of the Korean currency against the dollar.

A few hours after the FOMC announced its rate decision, the country’s top finance authorities, including BOK Gov. Rhee Chang-yong and Finance Minister Choo Kyung-ho, held a meeting.

Choo welcomed the decision, saying the Fed’s rate raise will lead to a decline in economic volatility for Korea, a country heavily dependent on exports.

“However, if the gap in the market expectation and the Fed continues on potential rate fall within the year, this could lead to more volatility of the global finance market in the future,” Choo said.

Meanwhile, Korea still needs to cool down ongoing inflation. Though market analysts have said inflation peaked last year, the numbers suggest otherwise.

Korea’s consumer prices, an important measure of inflation, climbed 5.2 percent on-year in January, according to the data released by the Statistics Korea on the same day. The prices of utility services, including electricity, gas and water bills, went up by 28.3 percent on-year, the highest record since the figures were measured separately in 2010.

With more price hikes slated for public utility charges such as subway and bus fares, consumer prices are unlikely to start to fall.

The central bank held a separate meeting on Thursday to discuss the ongoing inflation.

Lee Hwan-seok, a deputy governor at the BOK said, “The 5.2 percent figure meets expectations,” adding “February’s consumer prices index would be in the 5 percent range, too.”

Eyes on end-February

Eyes are now on the central bank’s next step this month. The next rate-setting meeting is slated to take place on Feb. 23.

“Three of the Monetary Police Board members viewed the terminal rate to be at 3.5 percent, while another three suggested 3.75 percent,” BOK Gov. Rhee said at a press conference last month after the central bank decided on the base rate.

Experts view that the central bank is likely to maintain the key rate at 3.5 percent this month.

“The Bank of Korea is likely to freeze the rate,” Kang Seung-won, a researcher at NH Investment & Securities, said. Kang even projected a rate fall could begin earlier than expected.

“It was anticipated the central bank could go for a rate fall in the fourth quarter of this year. This may come faster than the projection,” he said.

Others also shared the same view.

“With the Fed’s rate hike cycle nearing the end, the Bank of Korea is less likely to go for further rate hikes,” Lim Jae-kyun, an analyst from KB Securities, said. The currency risk is not grave, as the gap between the Korean won and US dollar did not widen as much as concerned, he added.