April 25, 2025

SINGAPORE – The fashion industry has been rocked by a wave of Chinese TikToks “exposing” luxury brands in recent weeks.

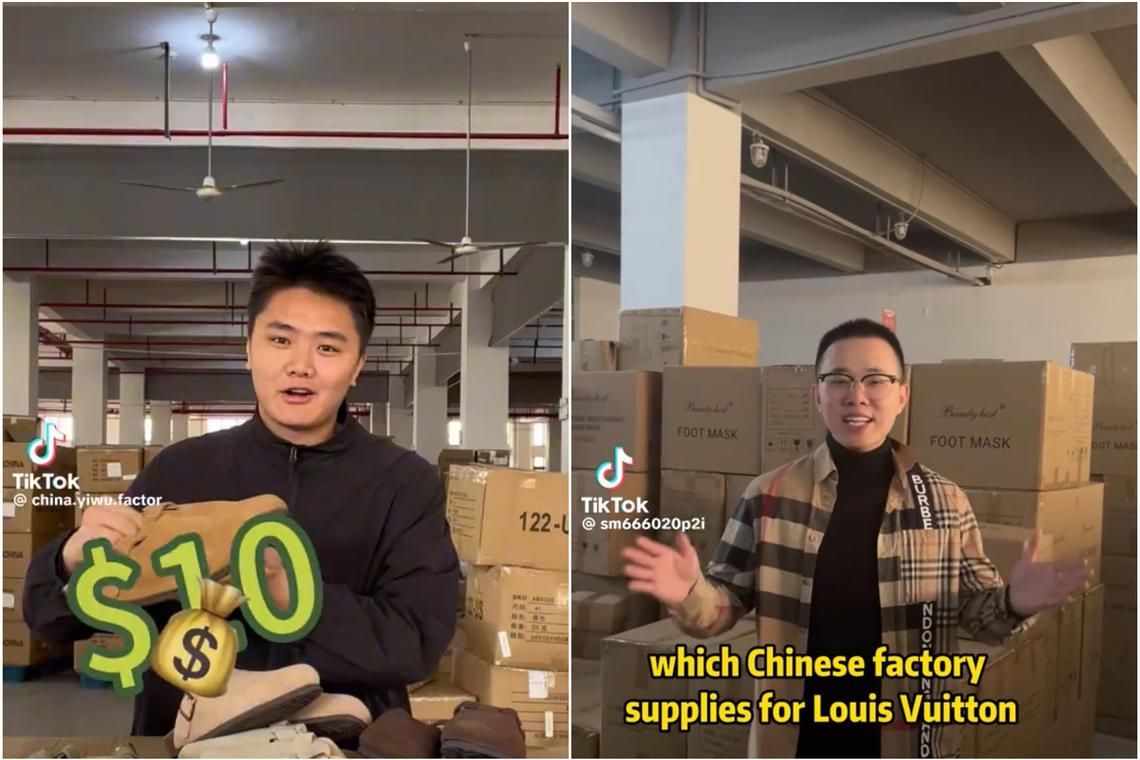

A response to United States President Donald Trump’s tariffs of 145 per cent against China, these viral videos are fronted by supposed factory workers, brand owners and sourcing agents who claim to be the Chinese manufacturers behind Europe’s most prestigious luxury brands.

Others have gamely revealed the names and addresses of factories in China responsible for supplying to Lululemon, Birkenstock, Zara and other high-street brands.

A video from the now-removed account Sen Bags racked up millions of views before it was deleted. The speaker broke down the “true cost” of making an Hermes Birkin: US$1,400 (S$1,840), less than one-tenth of the retail price.

In another, he showed handbags in every recognisable silhouette from the top fashion houses – Hermes, Chanel, Louis Vuitton, Gucci.

“As the USA and its little European brothers are trying to refuse Chinese goods, don’t you think luxury brands are not trying to move their OEM (original equipment manufacturers) out of China? Yes, they did, but they failed – because the OEM factories out of China don’t have good quality control and don’t have as good craftsmanship,” he said confidently.

He then advertised the brand’s website to sell directly to consumers. Why not cut out the middleman and get a deal, to soften the blow of the tariffs?

Mr Trump seemingly did a U-turn on April 23 and said his tariffs on China would come down “substantially”, but the damage has been done.

The direct-to-consumer prices sound almost too good to be true. Could they be the real deal?

The short answer is no. It would be hasty to rule out the possibility of a luxury brand outsourcing parts of its production to factories in China.

Industry players will tell you it is common practice to manufacture various components of a product all around the world, wherever the expertise is strongest. The final product might then be assembled, stamped or finished with a label in a European country – to give it that coveted “made in France/Italy/Spain” authenticity.

These viral videos are fronted by supposed factory workers, brand owners and sourcing agents who claim to be the Chinese manufacturers behind Europe’s most prestigious luxury brands. PHOTOS: SCREENGRAB FROM SENBAGS2/TIKTOK, ROSIE.SPORSWEAR/TIKTOK/THE STRAITS TIMES

But manufacturers for luxury brands would most likely have had to sign non-disclosure agreements or, at the very least, contracts that prevent them from leveraging and profiting off a brand’s hard-won name and prestige.

Part of a network for fakes

What seems more likely is that these are existing players in the intricate network of knock-offs, which experts have valued as a billion-dollar racket.

In its 2024 State Of The Fake annual report, AI-powered luxury authenticator Entrupy estimated that counterfeit goods make up 3.3 per cent of current global trade. International provider of brand protection and trademark solutions Corsearch predicted that the size of the global counterfeit goods market could reach US$1.79 trillion by 2030.

And not all fakes are made equal. Even counterfeits have grades – the best-quality ones are a small but growing subset referred to as superfakes and “replicas” – with a monied demographic willing to shell out for the best.

In April 2022, New York publication The Cut wrote a feature on how wealthy women in New York spent their money on top-grade fake Hermes Birkins, leveraging their elite status in society to cut back on spending but not reputation. These women bought from fellow New Yorkers who acted as middlemen, working with a network of sellers mostly in China.

The ongoing trade war may have emboldened these once-faceless sellers to come out of hiding and advertise directly to consumers. But beyond that, the enthusiastic comments in the videos expose something deeper: a growing preference for buying fake and, consequently, a declining appreciation for luxury brands.

These sentiments come at a time when luxury is already facing immense pressure – from falling demand, the rise of dupe culture and counterfeit app DHGate, scandals exposing the “true” cost of a designer bag (as low as US$57) and the looming threat of a recession.

In Entrupy’s report, 71 per cent of the 25,000 people surveyed found it acceptable to buy counterfeit goods when the price of the original product is too high.

Moreover, as counterfeits are produced with increasingly higher quality, there are fewer faults to be found. Replicas these days can nail the same tiny details authenticators once used to distinguish a real from a fake – date codes, stamps, tannery labels and serial numbers.

It has raised questions about what constitutes luxury. Is it the actual part, the quality of material used, the factory or origin of production? Does a logo maketh all? And does buying it from the boutique warrant a mark-up many times over?

Consumers, it seems, have become disillusioned with the luxury world’s former mystique and the high mark-ups they have been conditioned to pay.

Counterfeits pose risks to brands in reputational damage, by diluting the perceived value or prestige of the brand. But there are some who would be happy to circumvent long-established gatekeeping and see the monied world of luxury get taken down a notch or two.

Redefining ‘made in China’

Perhaps the silver lining in this entire debacle is the realisation that “made in China” is not as damning a label as it used to be – and is finally getting the credit it deserves.

Call it Western propaganda or just plain ignorance, but it has been eye-opening to see the Sinophobia in the comments section of various TikToks. Some viewers are astonished at the fact that Chinese production facilities are not the dirty, slave-driven sweatshops churning out poor-quality products they were once thought to be. (Not all, at least.)

Quite the contrary. As Sen Bags and other videos show, these are pristine workplaces with sophisticated factory lines, high-tech capabilities, well-kept premises and colour-coded storage facilities.

(Left) A TikTok account advertising $10 shoes that look conspicuously like Birkenstocks. (Right) TikTok account SM666020p2i allegedly exposing the Chinese factories manufacturing Louis Vuitton.PHOTOS: SCREENGRAB FROM CHINA.YIWU.FACTORY/TIKTOK, SM666020P2I/TIKTOK/THE STRAITS TIMES

These are not revelations new to Singaporeans. As seasoned shoppers on Taobao, Shopee and other e-commerce marketplaces, we have long been familiar with the efficiency and quality of Chinese manufacturing. Many local fashion brands and blogshops produce or drop-ship their items from Guangzhou, a known hub for wholesaling.

Even DHGate started as a regular business-to-business and business-to-consumer cross-border e-marketplace before it became associated with counterfeit goods in the West. The app topped Apple’s app store in the US in the past week.

With the conversation in motion, the definition of luxury will continue to evolve.

But there will also always be a segment of the population willing to pay the high mark-ups for buying designer. This is simply because they can or perhaps because they feel it is a fair price to pay for a juggernaut’s history and years of marketing. After all, marketing and creative teams cost money too.

It comes down to the question: Why are you buying the branded item in the first place? If it is for prestige or in appreciation of the brand’s history, craft and values, then a piece direct from China, no matter how well-made, will never cut it.

But if you choose to buy the fake to stick it to the man or just to enjoy the style at an affordable price, then by all means. No need to demonise the brand for pricing it however it wants.