May 2, 2024

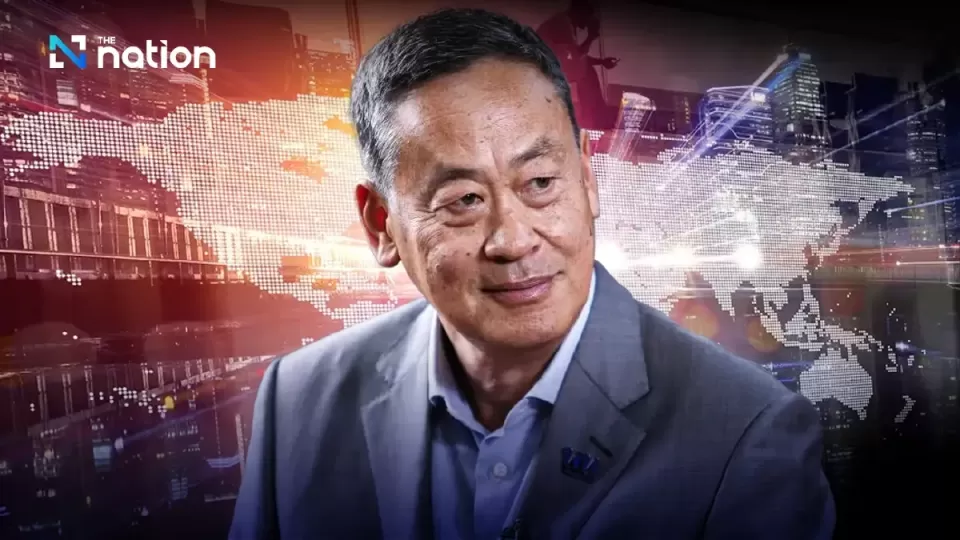

BANGKOK – The Cabinet reshuffle last week saw Prime Minister Srettha Thavisin pass on the finance portfolio to Pichai Chunhavajira, the former chairman of the Stock of Thailand (SET). Analysts believe the premier’s move to appoint Pichai as the new finance minister was aimed at reducing his confrontations with the Bank of Thailand. The central bank has ignored for months Srettha’s pleas to lower the key interest rate.

Before the reshuffle, Srettha, who was also the finance minister, had invited bank executives to discuss current economic challenges. After the meeting, the Thai Bankers’ Association announced a reduction in the minimum retail rate by 0.25 percentage point for prime retail customers identified as vulnerable.

This reduction applies to both individual customers and small and medium-sized enterprises and would be effective for a period of six months, said the association. Joining the campaign were: Export-Import Bank of Thailand, Government Housing Bank, Bank for Agriculture and Agricultural Cooperatives, Bangkok Bank, Government Savings Bank, Krungthai Bank, and Thai Credit Guarantee Corporation.

On Tuesday, Kasikornbank announced that it would also cut the interest rate by 0.25 percentage point for six months for vulnerable customers, a number estimated at 200,000 people with combined loans of 82 billion baht, effective from May 16.

The Bank of Thailand’s Monetary Policy Committee (MPC) had on April 10 decided to hold the policy rate at 2.5%, explaining that the rate was suitable for maintaining the country’s economic and financial stability.

Krungsri Research predicted that despite the latest move by the MPC to hold the policy rate, the committee could still cut the rate in the near future when new information is presented.

The research centre was referring to Thailand’s plummeting exports in March, a 10.9% contraction year on year, the lowest in eight months. As one the major engines of growth, the export performance could throw a wrench in the central bank’s prediction of Thailand’s economy expanding in the first quarter of 2024 by 1%.

Other factors that could slow down the Thai economy include decreasing manufacturing activity and private investment, as well as the impact of drought and the El Nino phenomenon on the agricultural sector.

CIMB Thai Research Centre said that cutting the interest rate by 0.25 or 0.50 percentage point was not enough to stimulate the economy, adding that the rate needed to be cut by 1.25 percentage point for the economy to attain pre-Covid-19 levels.

Cutting the interest rate also has a side effect: It could weaken the baht, potentially sparking a currency war with neighbouring countries, whose competitiveness could be undermined by the baht’s weakness.

In the end, the currency war could lead to the weakening of all currencies in the region.

The baht, as of April 30, was valued at 37.06 to the US dollar, slightly weaker than the previous day’s closing price of 37.03 per US dollar.