July 13, 2022

DHAKA – The world is going through one of the worst energy crises in recent times, even if we compare it to the situation that arose out of the 1973 Arab oil embargo. The 2008 economic meltdown and the consequent high oil and food prices were relatively short-lived. The Covid pandemic and then the Russia-Ukraine war have kept all energy prices very high for a long time. The world electricity demand in the second half of 2020 during the Covid lockdown period went down by three percent. Energy demand dipped drastically. In June 2020, the LNG spot price went down to USD 2.05/MMBtu, Newcastle coal was at USD 50/tonne, and oil price hit a negative value on April 20, 2020. As a result, a large number of energy supply operations, especially the small ones, shut down. The larger supply outlets also cut down operations. The world economy started recovering in early 2021 and the energy price rallied back. The economic rebound was sudden. Many of the supply operations in the coal, gas, and oil sectors could not recover at all or scale up to meet the demand. The gas sector was the worst hit and a serious supply shortage peaked the Asian spot LNG price at USD 35/MMBtu in October 2021. The high gas price put pressure on other fuels, especially coal for power production.

Newcastle thermal coal hit USD 266/tonne at the same time – a five-time increase. The crude price increase was moderate but product (gasoline, diesel) prices kept on going up due to refinery limitations. Amid this crisis, Russia invaded Ukraine on February 24, 2022. The Asian LNG spot price on February 22 was USD 28/MMbtu, coal on February 25 was USD 237/tonne and Brent on February 23 was USD 99.29/bbl – all of them were at a higher level than the previous five-year averages. The fear of Russian supply disruption saw a record high price of USD 70/MMBtu and USD 412/tonne of gas and coal price, respectively, in March 2022. Currently, the gas spot price is over USD 40/MMBtu, coal at about USD 160/tonne (some demand destruction took place) and Brent at USD 105/bbl.

How is the world facing this challenge?

This unprecedented long period of high energy prices and supply shortage are exerting tremendous pressure on all economies – developed, developing, and poor countries are facing a serious cost-of-living challenge. Even the US, which is relatively insulated from global energy prices, is experiencing record inflation. Food supply, shipping space/container shortage, and other supply chain issues along with the energy price are threatening recession in many countries. Russia provided 40 percent of Europe’s gas. It also supplies 12 percent of world’s crude oil, and half of that went to Europe. The war and the subsequent sanctions have created a partial supply shortage in most European countries. As a result, gas and electricity prices have gone up by 40 percent in Europe. France, Denmark, Germany, England, Spain, the Netherlands, and other countries are paying a direct subsidy to the poorer households. Some of them are putting a price cap on utilities, forcing them to bear the cost. Spain levied a windfall tax on energy companies that made record profits and planned to distribute 2.4 billion euros to the consumers out of that revenue.

The high European gas price is dictating prices all over the world. Even the US gas price, which is disconnected from the external supply, is seeing a high price increase. The biggest challenge is faced by the import-dependent developing countries. China and India have reduced their LNG imports by 20 percent and 14 percent, respectively, in the first half of 2022, compared to the same period in 2021. Several provinces and cities in China are planning “orderly” electricity consumption. India suffered a widespread power outage and Coal India is going to import coal for the first time since 2015. Pakistan reduced its work days to five days a week and is restricting commercial power usage. Currently, it is generating 5,000MW less than its demand. The energy import burden of more than USD 6 billion is creating a crippling effect on its dwindling foreign currency reserves. Sri Lanka depends 60 percent on imported fuel (oil/coal) for its power production. Its mismanaged economy and almost empty foreign currency reserves have put the country into chaos.

Even the advanced Asia and Oceania countries are facing difficulties. Apart from rate adjustment, Singapore chartered floating vessels for LNG storage to ensure supply. Japan is going for major demand-side management by asking citizens not to use air conditioners. The Australian energy minister has requested the residents of New South Wales province not to use electricity for two hours in the evening. Apart from some oil/coal/gas producing countries, every country is scrambling for austerity measures.

Bangladesh’s case

For not adding generation capacity, Bangladesh faced increasing power outages from 2000 onward. The BNP government came up with oil-based rental power plants to tackle the situation that was picked up by the caretaker government, and the first 10 rental power plants were awarded in 2008. Despite initial opposition, the Awami League government had to add more oil-based rental plants from 2010. There was no other alternative to addressing the severe load-shedding, which was hampering economic growth. In the meantime, the power sector problem shifted from a lack of generation capacity, to a shortage of primary energy. In 2007, the gas shortage started with a 300 mmcfd shortfall that could never be mitigated. Today, the gas deficit is estimated at 1,300 mmcfd. Both the Power System Master Plan (PSMP) 2010 and PSMP 2016 accepted this deficit and, instead of emphasising local exploration (although PSMP 2010 relied 30 percent on its future power generation plan from local coal, which was abandoned in the 2016 plan), depended heavily on imported fuel. Although the government did not follow these plans, fuel import dependency kept on increasing, putting the country at an international price and supply fluctuation risk. The legacy problem of generation got much more attention, putting the primary energy issue on the backburner. Every time the issue of high future energy import bill was raised, the growing economic strength was shown as a solution.

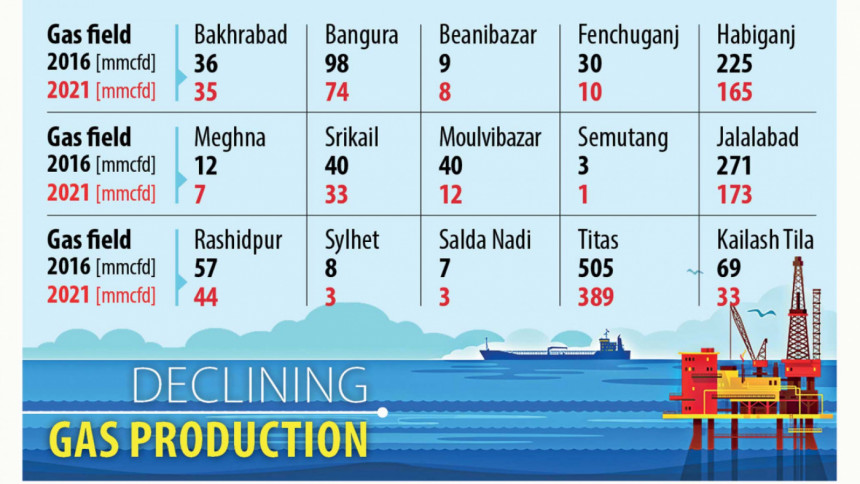

The Bapex-only local exploration policy resulted in only one drilling a year in the last 20 years, and despite settling the maritime boundary in 2014, offshore activity was questionable and half-hearted. Petrobangla miserably failed to maintain the production plateau reached during 2016-17. Any hope of local coal development was shut down in 2012. Bangladesh started to move away from energy independence at a much faster rate than was needed in the absence of local exploration and exploitation. For fuel and source diversification, and hence better energy security, the import of LNG and coal was needed and should have been started earlier. Our lack of experience in international energy trading was exposed when we opted for a four-tonne long-term contract for the 7.2-tonne LNG capacity. A large option spot portfolio is never recommended in a perpetual supply deficit situation.

The overcapacity dilemma is a trap created by the government. Out of 25,500MW of electricity generation capacity, 3,500MW is off-grid (solar home and captive), while 4,000MW cannot be operational because of forced/unforced shutdown and fuel shortage. Including derated capacity and plant availability, the true grid capacity is about 16,000MW. Unless the government decommissions the idle 3,000MW capacity it is carrying on paper, the overcapacity question will not go away. The other question of capacity payment is more complex. Every power plant is paid a capacity cost varying between Tk 1.25-2.4/kWh. This is part of the generation cost allowing investors to get their money back during the project period. The older long-term projects have a lower charge. If an HFO plant generation cost is Tk 15/kWh, Tk 2 would be the capacity cost and Tk 13 the fuel cost. Similarly, an old CCGT gas generation IPP cost is Tk 3.5/kWh, and Tk 1.25 would be the capacity cost.

During the entire winter season, almost all oil-based power plants are kept on standby, receiving capacity cost. During peak summer, when peak demand increases by 5,000MW now, the majority of them are used. Is there a scope of corruption there? Some corruption definitely happens, but the vast majority of the capacity payment for oil-based plants that is being questioned is the payment during their idle period. Several unnecessary standby capacities are hardly used. They must be scrapped first, but oil-based capacity cannot be discarded entirely now until the larger coal-based base load plants come online.

We are paying for our past mistakes. We could easily get a six-tonne long-term LNG contract; we should have parallelly given much more attention to local gas development along with import. We were slow in bringing in the large coal-fired power plants (Rampal is taking almost 12 years from inception) extending the life of the oil plants, etc. One can find many more problems. We made some policy mistakes as well as execution delays/mistakes. None of those can be reversed immediately, but a course correction is essential. All avenues for immediate exploration of both onshore and offshore gas prospects must be undertaken, the land-based LNG regasification plant with assured gas sourcing is needed, and a serious impartial examination of local coal development by a third party is needed before we make a final decision.

To secure a more certain supply of power in the immediate future, the government must ensure timely completion of all ongoing coal-based power plants, their coal supply and import infrastructure, and the completion of the necessary transmission lines for power evacuation. We are paying over Tk 100 crore capacity charges per month for over 1.5 years for one unit from the Payra power plant, because the transmission lines are still incomplete. We simply cannot afford to do that for other power plants – especially our only nuclear power plant.

Our current energy crisis is unique. The planned load-shedding is perhaps the best way of keeping the tariff at its current level. It will also ease the foreign currency demand, which is the other reason for this measure. Special care should be taken for the most productive sector (industry/agriculture) in allocating both gas and power. Every bit of renewable energy, including rooftop, household, irrigation, streetlights, etc, must be supported through policy and finance. It is expected that due to demand destruction and probable recession in some countries, energy prices will come down soon (except gas). Along with forced saving, citizens need to conserve energy as much as possible.