September 25, 2025

PETALING JAYA – Many employers, especially micro, small and medium enterprises (MSMEs), are scaling back staff health benefits as soaring insurance premiums drive up operating costs, says the Malaysian Employers Federation (MEF).

MEF president Datuk Dr Syed Hussain Syed Husman said the employers are resorting to basic policies, co-payment schemes and cutting dental, optical and dependent coverage.

He warned that the impact of rising insurance costs on businesses could undermine worker morale, fuel turnover and make it harder to attract talent, thereby weakening Malaysia’s competitiveness as a business hub.

He said the steep rise in premiums for employee medical coverage, liability policies as well as fire and property insurance, is affecting companies across sectors.

The impact is most pronounced among MSMEs with limited cash flow.

“Employers have had to make difficult adjustments, including lowering benefit ceilings, limiting the types of medical procedures covered, or switching to basic plans.

“This, to a certain extent, assists company finances but erodes employees’ sense of security and undermines benefits competitiveness.

“Some are passing the increased costs to employees through higher co-payments or salary deductions, while others raise product or service prices to offset expenses.”

Syed Hussain said this in response to a survey by global professional services firm Aon, which found healthcare costs to be a key concern for employers in Malaysia.

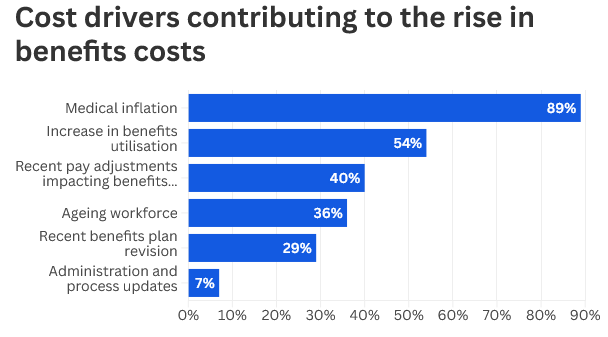

The Aon 2025 Malaysia Employee Benefits and Wellbeing Report said employers are seeing five to 10 percent annual benefits cost increases, primarily due to rising medical costs and increased benefits usage.

SOURCE: AON 2025 MALAYSIA EMPLOYEE BENEFITS AND WELLBEING REPORT/THE STAR

Based on a survey of 130 companies and 507 employees in Malaysia, the report said that such a financial pressure may lead employers to reconsider benefit levels, challenging employers to maintain or curate a competitive benefits package.

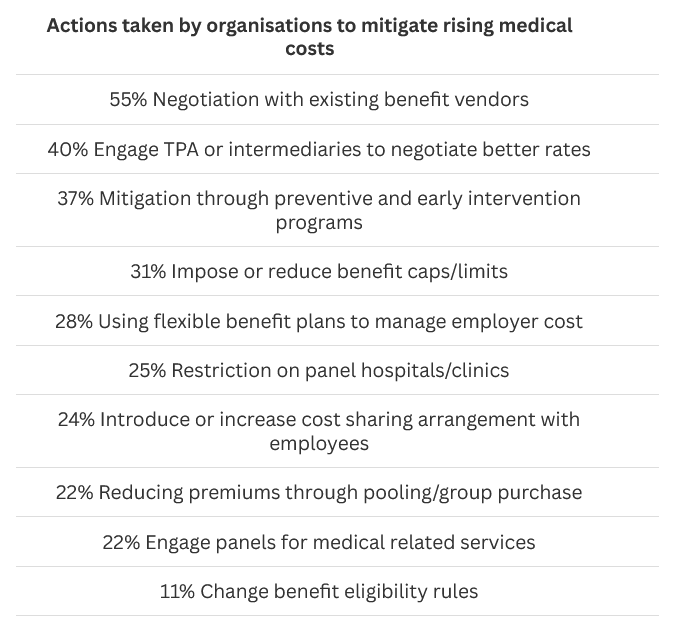

SOURCE: AON 2025 MALAYSIA EMPLOYEE BENEFITS AND WELLBEING REPORT/THE STAR

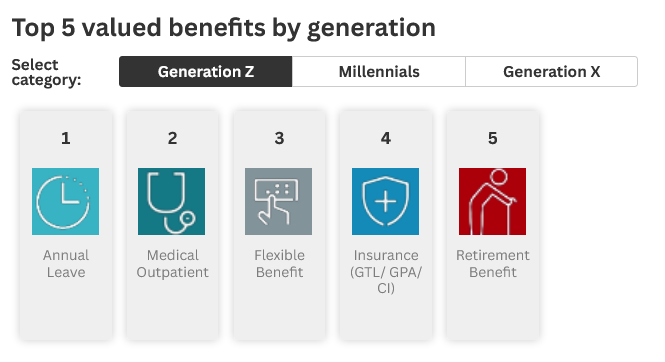

SOURCE: AON 2025 MALAYSIA EMPLOYEE BENEFITS AND WELLBEING REPORT/THE STAR

Bank Negara Malaysia (BNM) has projected healthcare and medical costs to rise by 15% this year, compared with 10% globally and 11% in the Asia-Pacific region.

The Department of Statistics Malaysia reported that the Consumer Price Index (CPI) for health-related insurance jumped to 124.3 in July 2025, up from 108.8 the previous month. The CPI for outpatient health services has also risen steadily, reaching 159.1 in 2024.

SOURCE: DEPARTMENT OF STATISTICS MALAYSIA/THE STAR

An ageing population, the rise in non-communicable diseases, advancements in medical technology and increased investments in medical equipment and treatments are among the factors driving Malaysia’s medical inflation.

To respond to the rising costs, BNM introduced the RESET health financing initiative which aims to improve the country’s healthcare financing system.

A joint ministerial committee involving the Finance and Healthcare ministries is also working to produce measures to address the problem.

Syed Hussain said larger companies, such as multinationals and government-linked corporations, often absorb the higher medical insurance premiums to preserve staff morale.

But this reduces profitability and diverts funds away from growth initiatives, he noted.

He said while many companies still maintain the appearance of providing “coverage,” the breadth and quality of healthcare benefits have declined.

He added that for MSMEs, which employ the majority of Malaysia’s workforce, this situation may accelerate labour informality.

The term labour informality describes economic activities and workers who operate outside of formal regulations, lacking legal protection, social security, and compliance with income taxation and labour laws.

He said the strain may also push some employers to forgo formal insurance benefits altogether.

“The lack of transparency in how insurers determine premiums, particularly in group medical coverage, is a major concern.

“Employers are calling for intervention to ensure fair pricing, pooled risk-sharing mechanisms, and more affordable options for MSMEs,” he said.

Syed Hussain said employers were taking various measures to cope, including renegotiating policies, consolidating coverage under one insurer, trimming ancillary benefits, and introducing co-payment models.

“A growing number are shifting to takaful-based coverage, which is seen as more transparent and may offer better value.

“Some are exploring hybrid arrangements, such as combining basic insurance with self-insurance or internal medical funds for routine claims.

“Others are investing in wellness programmes and health screenings to reduce long-term claims,” he said.

Syed Hussain cautioned that persistent double-digit hikes in medical insurance were unsustainable.

“Without systemic reforms, employers are trapped between rising costs and their obligation to provide adequate healthcare benefits coverage.

“This is not simply a business issue but a matter of national workforce sustainability,” he said.

He urged insurers and authorities to engage more closely with employers to ensure medical insurance remains affordable and predictable.

“Without a balanced approach, escalating costs will deter employers from providing coverage altogether, worsening the social protection gap and putting greater pressure on public healthcare facilities,” he said.